Houston and Harris County are being hit hard by the dual challenges of COVID-19 and a slowing energy sector. The Texas Workforce Commission reports that 350,000 unemployment insurance claims have been filed in Harris County since mid-March. Thousands more residents have been furloughed or seen incomes fall because of lost hours.

The drops in income for hundreds of thousands of households in our region presents a massive challenge to our housing sector. While federal stimulus and local eviction moratoria have helped slow the most drastic impacts of the coronavirus pandemic for many families, the exhaustion of those funds and expiration of programs between May and July puts the region and nation at the edge of a housing crisis cliff. Locally, we are already seeing rising rates of eviction filings since the state’s eviction moratorium expired in May.

The Terner Center for Housing Innovation at Berkley estimates that 362,000 renter households in the Houston metro area have had at least one member lose a job during the COVID-19 pandemic. These households pay, Terner estimates, at least $420 million in rent. Lost income puts many of these households at risk for eviction, which can create a knot of problems for the households and for the social services sector attempting to serve them. While the renter households are the most vulnerable, the lost rent threatens the owner’s business and can have ripple effects through the housing market.

The pandemic and energy bust are taking a huge toll on the region and, over the long-term, these interlocking challenges will have lasting impacts on people’s lives and how they interact with the region’s housing system.

To track those long-term impacts and understand how our region’s housing system is changing over time, today the Kinder Institute publishes “The 2020 State of Housing in Harris County and Houston” report. The project brings a wide range of housing-related indicators into one place and makes them accessible for all stakeholders. The report synthesizes several key issues and indicator data that is available at the county and city level (in the appendix of the report) and the neighborhood level (via the Houston Community Data Connections site).

This inaugural report does not reflect COVID-19’s impact in every indicator, however. The way that census data is collected and shared means there is a lag between survey year and release. Because of this, the bulk of data about COVID-19 will not be available until 2021 or 2022. This initial report, though, does provide a critical baseline about our housing system and the gaps that existed within it even before COVID-19 hit. Reports in subsequent years will allow us to understand the ways in which the pandemic and the energy bust have deepened issues, especially among the most vulnerable in our community.

What is clear from the inaugural report is that Harris County and Houston are already facing a significant challenge in providing safe and affordable homes for all residents. While Greater Houston has a reputation for housing affordability, many of the findings of this report show that this affordability is disappearing within the city of Houston and Harris County. Much of tightening is due to rising home prices and rents. For current homeowners, the growing home values have been a boon to many households’ biggest asset.

But, the loss of affordability that comes with rising home prices and rents is falling heaviest on renters. Middle-income renters, those traditionally expected to enter into homeownership, are finding themselves without the resources to buy even a median-priced home in Houston or Harris County, thus forcing them to remain as renters. Low-income renters face quickly increasing rents across the county and are squeezed into the few areas where affordable rentals still exist. For low-income renters, homeownership is a near-impossibility without significant public subsidy.

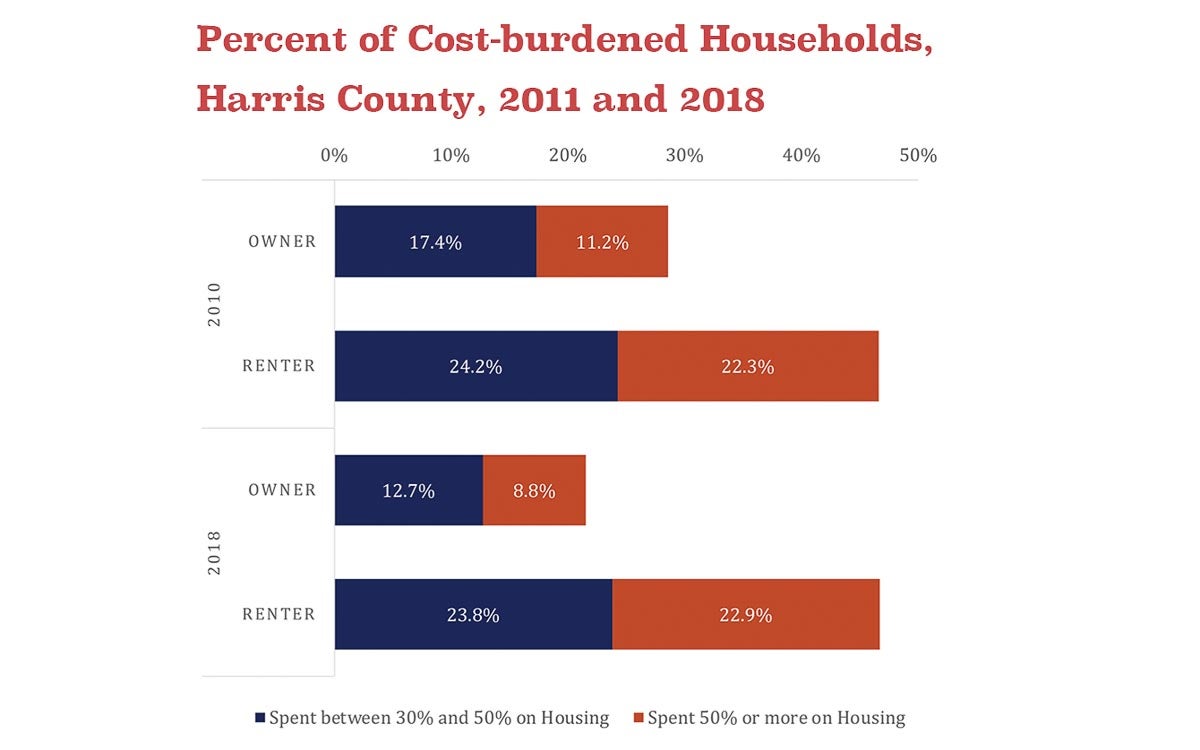

The rising prices mean that nearly half the renter households in Harris County are spending too much on housing. In 2018, about 335,000 renter households (47% of the total renter households) in Harris County paid more than 30% of their income toward housing, classifying them as cost-burdened. Of that number, about 164,000 renter households (23% of all renter households in Harris County) paid rent that was greater than 50% of their income, classifying them as severely cost-burdened. The total number of cost-burdened renters in Harris County grew between 2010 and 2018 by 24%. The growth in cost burden means that renter households have fewer financial resources to pay for other needs such as health care, education or food. As home prices rise faster than incomes, more and more households are feeling pinched.

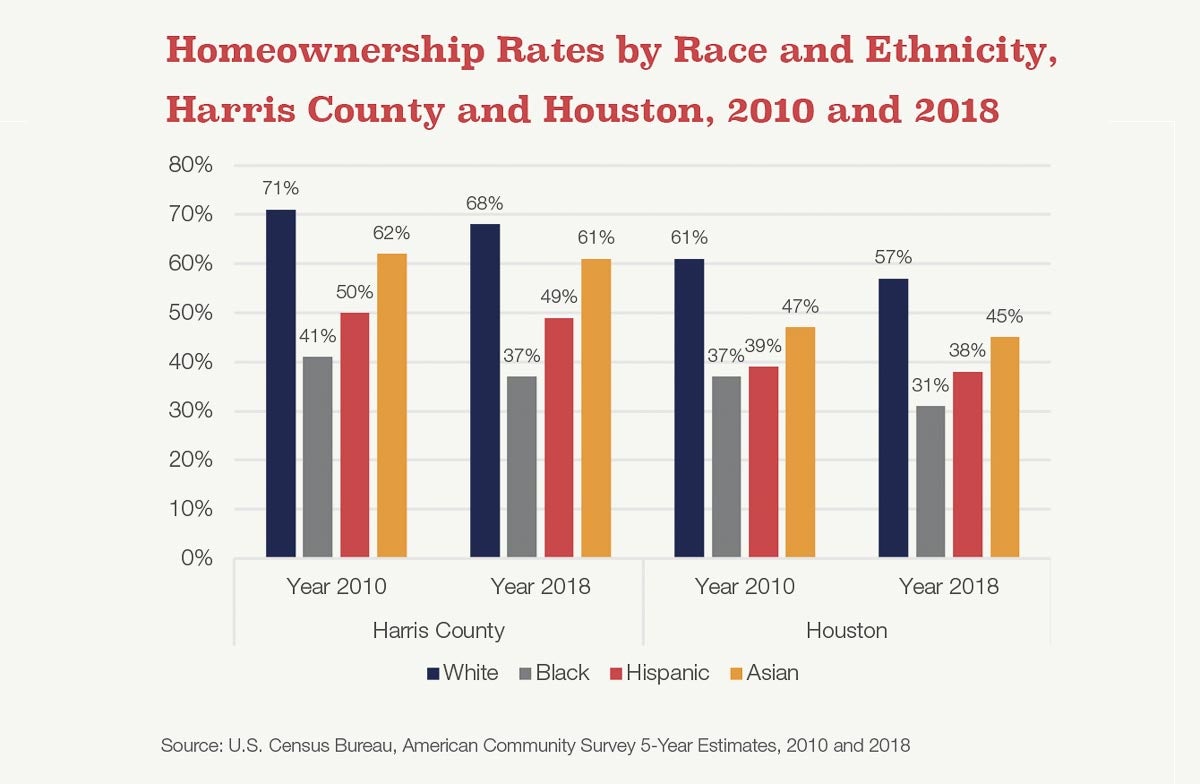

Another important trend to highlight is the declining rate of Black homeownership. While ownerships have been declining across racial and ethnic groups in cities throughout the country since the 2008 financial crisis, the issue is particularly acute for Black homeowners. While all groups saw declines in homeownership between 2010 and 2018, Black homeownership fell the most and to the lowest percentage overall. Black homeownership fell from 41% in 2010 to 37% in 2018 across Harris County, and from 36% to 31% in the city of Houston. White homeownership fell from 72% to 68%, while Asian homeownership fell from 63% to 62%, and Hispanic homeownership fell from 50% to 49%.

Given that homeownership is a major form of generational wealth production, the decline of ownership in Black households means that many are unable to secure the opportunity to accrue assets and pass those on to future generations.

The findings of the 2020 report show the connections that the housing system has with so many other issues. At this moment in which calls for racial justice and equity are primary, the observations about how our housing system is or is not working for certain groups of residents are critical to ask. In order to address those shortcomings and limitations, we must first grapple with the extent of the issue.