When the Census Bureau released its latest national estimates Tuesday, it was good news for much of the country with annual increases in median incomes nearly across the board -- and the biggest annual increase in median household incomes ever recorded.

But here in Houston, that picture was tempered with the release of more detailed estimates from the American Community Survey Thursday.

Showing signs of the recent oil slump, the latest estimates for the Houston metropolitan area reveal an economic slowdown in comparison to other major cities in the state and country.

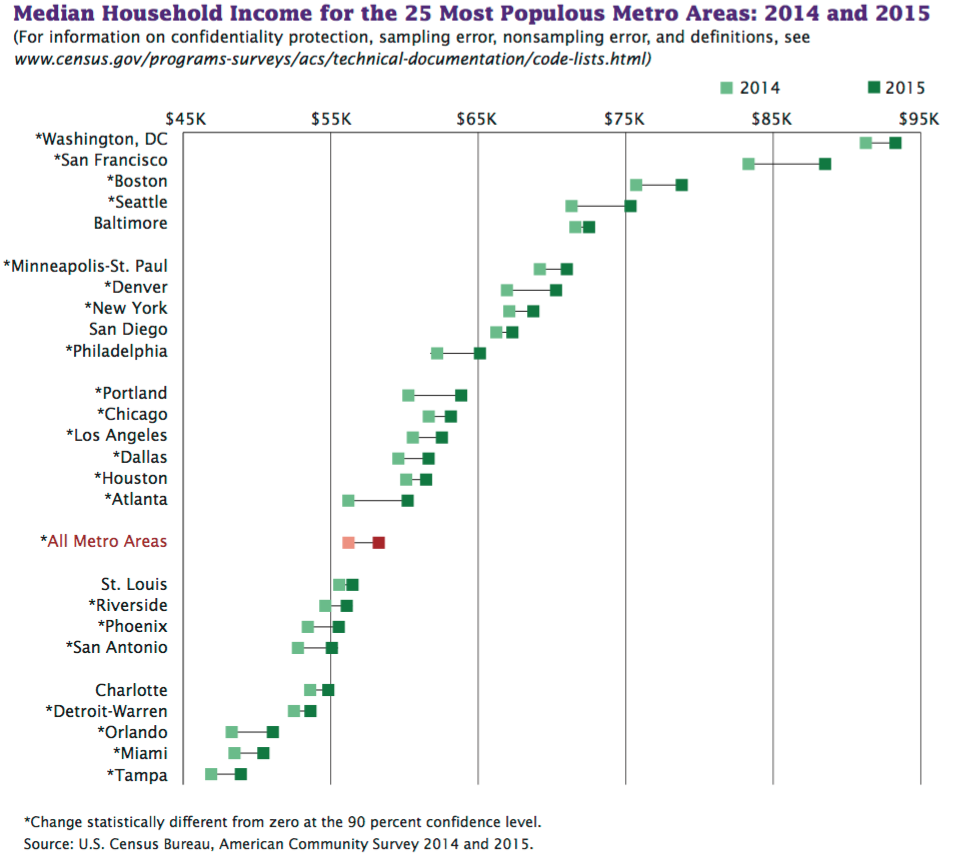

The latest estimates capture the impact of the oil bust, which began in late 2014, on the Houston area. So while metro areas like Atlanta saw its median income increase 7.1 percent from 2014 to 2015, the median income in the Houston-The Woodlands-Sugar Land area only increased 2.2 percent. That's dramatically less than the national average household income increase of 5.2 percent.

And it's not surprising, given recent figures releases by local economists.

"The official employment figures for Houston show weak growth in an economy that is directionless and apparently waiting for oil markets to provide some direction," according to a recent report from the University of Houston's Institute for Regional Forecasting.

"After creating only 20,700 jobs in 2015, Houston lost 4,600 jobs over the first seven months of the year," continued the report. The report notes, though, that other industries continued to post gains while the oil industry shed jobs. "Continued job gains have come in eating and drinking establishments (26,600), health care (22,000), retail trade (14,500), and local government (11,000)."

Since the Census estimates are slightly delayed, the picture they paint is of the first full year of the oil slump -- not the impact so far in 2016. What it shows is a metro area slowed, but not halted, by the slump. Partly due to the gains in other industries, the unemployment rate for the Houston area dropped from 5.7 percent to 5.6 percent from 2014 to 2015, according to the Census data. And the area's population still increased by 2.5 percent, adding more than 160,000 people from 2014 to 2015. Texas, meanwhile, only saw a 1.9 percent increase in population during that same time.

The Houston metro area's foreign-born population grew faster than the overall population, increasing roughly 4.8 percent. Most Houstonians are still born in Texas, but 2015 saw an increase in the percentage of people born in other Southern states living in the area, who now represent roughly 8.9 percent of the metropolitan area population.

Southern states like Mississippi and Louisiana had some of the highest poverty rates, and smallest annual median household income gains in the country, which may help explain the boost to their numbers here.

Article continues below graph.

But the Houston area's sluggish performance compared to its neighbors and other major cities across the country hints at the extent of the oil slump's impact and suggests that, while Houston has previously been called "recession-proof," the broad gains in income and decreases in poverty may mean that the rest of the country is catching up.

Both Dallas and San Antonio saw larger increases in median household incomes than Houston. Dallas even surpassed Houston's median income of $61,465 with a 3.4 percent increase that put its median income at $61,644.

Other major Sun Belt cities -- Miami, Los Angeles and Phoenix -- all had higher average income increases than Houston, at 4.0 percent, 3.3 percent and 3.9 percent respectively.

And though all three saw unemployment rates dip, Houston's only dropped a scant 0.1 percentage points, from 5.7 percent to 5.6 percent, between 2014 and 2015. San Antonio's unemployment rate in 2015 was still higher, at 5.8 percent, but had decreased by 0.5 percentage points from 2014. Dallas had the largest decrease and lowest rate, at 4.9 percent in 2015 compared to the previous year's 6.0 percent unemployment rate.

Article continues below graph.

Unsurprisingly, Houston also saw smaller decreases in its poverty rate than both Dallas and San Antonio, and it lagged behind many other major metropolitan areas, which saw decreases across the board.

Though the median household income only increased by 2.2 percent for the Houston metro area, the median gross rent, which includes rent and utility expenses, rose 4.4 percent between 2014 and 2015. That was even higher within the city of Houston itself where the median gross rent rose 5.2 percent.

Article continues below graphs.

Houston also lags behind other metro areas in health insurance coverage. The uninsured rate for the metropolitan area is nearly twice the national rate: 17.3 percent compared to 9.1 percent. Nationally, Hispanic people were responsible for the biggest gains in insured rates, increasing by 3.6 percentage points. But locally, the gains were smaller -- only 2.9 percentage points.

Because Houston is in a state that chose not to expand Medicaid eligibility after the implementation of the Affordable Care Act, it's unsurprising that it has a higher uninsured rate than metro areas like Los Angeles, which has a rate of just 10.7 percent. But Houston's rate is also higher than other major Texas cities, including Dallas, which has a rate of 16.3 percent and San Antonio, which has a rate of 14.5 percent.

Given the latest numbers, and barring what Gilmer, of University of Houston, calls a "convincing surge in oil prices," it seems Houston's sluggish 2015 may not improve in 2016. "If Houston has not already slipped into recession," writes Gilmer in his look at the oil slump through the first half of 2016, "it will be very hard to avoid recession going forward."