“The biggest difference has been feeling a sense of freedom,” Macklin said. “The main advantage is when something needs to be done you can get it done yourself, without having to wait on someone else to do it.”

This post is part of a series highlighting the findings from the 2024 State of Housing in Harris County and Houston report.

Macklin’s sentiment aligns with a key finding from the Kinder Institute’s 2024 State of Housing in Harris County and Houston report, where more than 75% of respondents said homeownership represented freedom.

The leading agency for Own the HOU is Houston’s Local Initiatives Support Corporation. Additional partners include the Houston Housing and Community Development Department, Fifth Ward Community Redevelopment Corporation, Houston Community Land Trust and the Harris County Community Services Department. The initiative defines people of color as members of the Black, Hispanic, Indigenous, and Asian communities.

Own the HOU is funded through the Wealth Opportunities Realized Through Homeownership (WORTH) grant program, which the Wells Fargo Foundation began in 2022. The WORTH program also has similar projects in Atlanta, Milwaukee, New York City, Philadelphia, San Diego and Richmond, Virginia.

Thus far, the Houston market has been the most successful, with about 2,300 new households created and over 260 homes preserved, according to Laura Jaramillo, executive director of the Houston office of Local Initiatives Support Corporation.

“Each of our partners are leading the way through different strategies,” Jaramillo said. “Many people think of it as a down payment program or homebuyer counseling. That’s only part of it. It’s also about outreach and an education campaign, and subtopics to that.”

Own the HOU also seeks to reach people who are interested in homeownership but do not know the pathways to achieving it. Member organizations have analyzed mortgage denial rates in the area, and have explored methods to reduce construction costs and expand housing typologies. Additional long-term aspirations include policy areas such as increasing the minimum wage and taking advantage of alternative credit scores to address systemic barriers.

Macklin was introduced to Own the HOU’s education and outreach program after engaging with a counselor from the Fifth Ward Community Redevelopment Corporation. Through the initiative’s courses, she learned about applying for the homestead exemption and about wills and estate planning.

“It was a very nice experience, and they made it easy,” Macklin said. “The classes that I attended were really helpful. Understanding the role your credit plays, and then as far as factors with paperwork with the Harris County Appraisal District — it was really in-depth.”

Additional resources geared toward closing the homeownership gap include the city’s Homebuyer Assistance Program. Households that are at or below 80% of the area’s median income are eligible to receive up to $50,000 toward their first home purchase.

Challenges remain

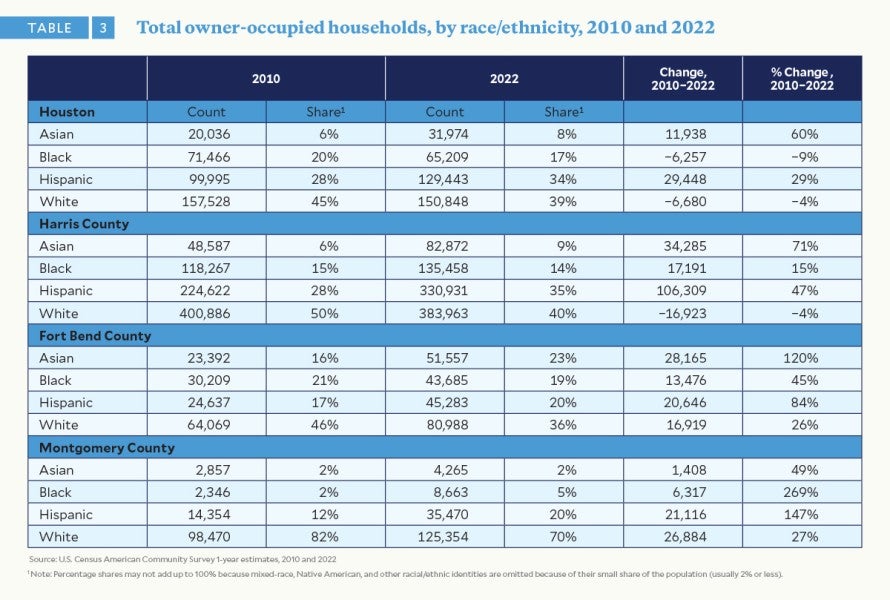

The 2024 State of Housing report indicated that the proportion of homeowners who identify as Asian or Hispanic was higher in 2022 than in 2010 in Houston and Harris County, while those who identify as Black or White were lower. However, Black owner households increased by over 17,000 in Harris County in that time period, but decreased by 6,257 within the city of Houston. Hispanic owner households increased by 106,309 in Harris County and by 29,448 in Houston.

Minority homeownership has also grown outside of Harris County and Houston. Between 2010 and 2022, Fort Bend County added 13,476 Black households, and Montgomery County added 6,317. Hispanic households increased by 20,646 in Fort Bend County and by 21,116 in Montgomery County.

“These growing homeownership numbers show that it’s increasingly the suburbs that represent Houston’s diversity,” said Kinder Institute research scientist Steve Sherman.

The White homeownership rate in the Harris-Fort Bend-Montgomery County region is 31 percentage points higher than Black households and 18 percentage points higher than Hispanic households, according to Understanding Houston.

“Despite our region’s diversity, the racial wealth gap is still very real and plays out in these homeownership differentials,” Sherman said.

Hurdles to homeownership

Jaramillo said low-paying jobs and repeated natural disasters are among the most significant challenges for people of color seeking home ownership. She described the home-buying process as intimidating. This echoes a 2024 Opendoor report on first-time homebuyers, in which 90% said the process was stressful.

Black and Hispanic mortgage applicants in Harris County are the most likely to be denied, according to the 2022 State of Housing in Harris County and Houston.

“There's a stigma around lending to people of color,” Jaramillo said. “There are also some other cultural issues. We aren’t always the best at talking to our younger generation about the importance of credit scores and how that impacts so much in our lives, including buying a home.”

To reach its goal of 5,000 new households of color by the end of next year, the collaborative has to contend with a new set of financial obstacles, such as higher interest rates and lower home availability. This year’s State of Housing report said there are no neighborhoods in Harris County that have median-priced homes affordable to those earning the median incomes of Black ($54,067) and Hispanic ($61,375) households.

“When we applied for the grant, we were in a different place economically,” Jaramillo said. “Homeownership was at a higher level. People were buying homes. Rates were great, and that immediately stopped once we were awarded the grant. Now we’re in a completely new era.”