This post is part of a series by the Kinder Institute for Urban Research addressing the findings of the 2021 State of Housing in Harris County and Houston report. Explore other posts in this series.

A Real Estate Investment Trust (REIT) is sort of like a mutual fund: investors pool their money into a managed trust, which then invests in assets and gives returns to investors. The difference is that a REIT invests solely in real estate and often issues rent-backed securities for additional income.

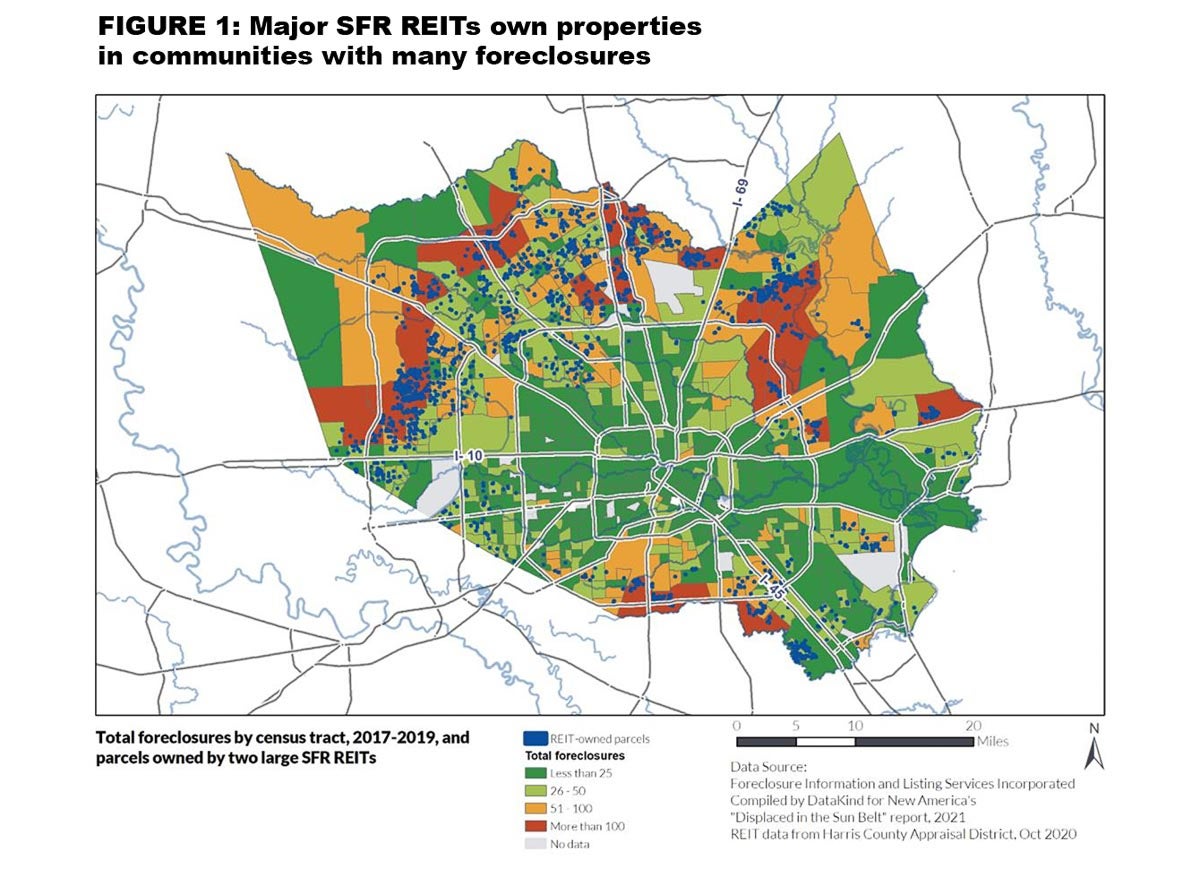

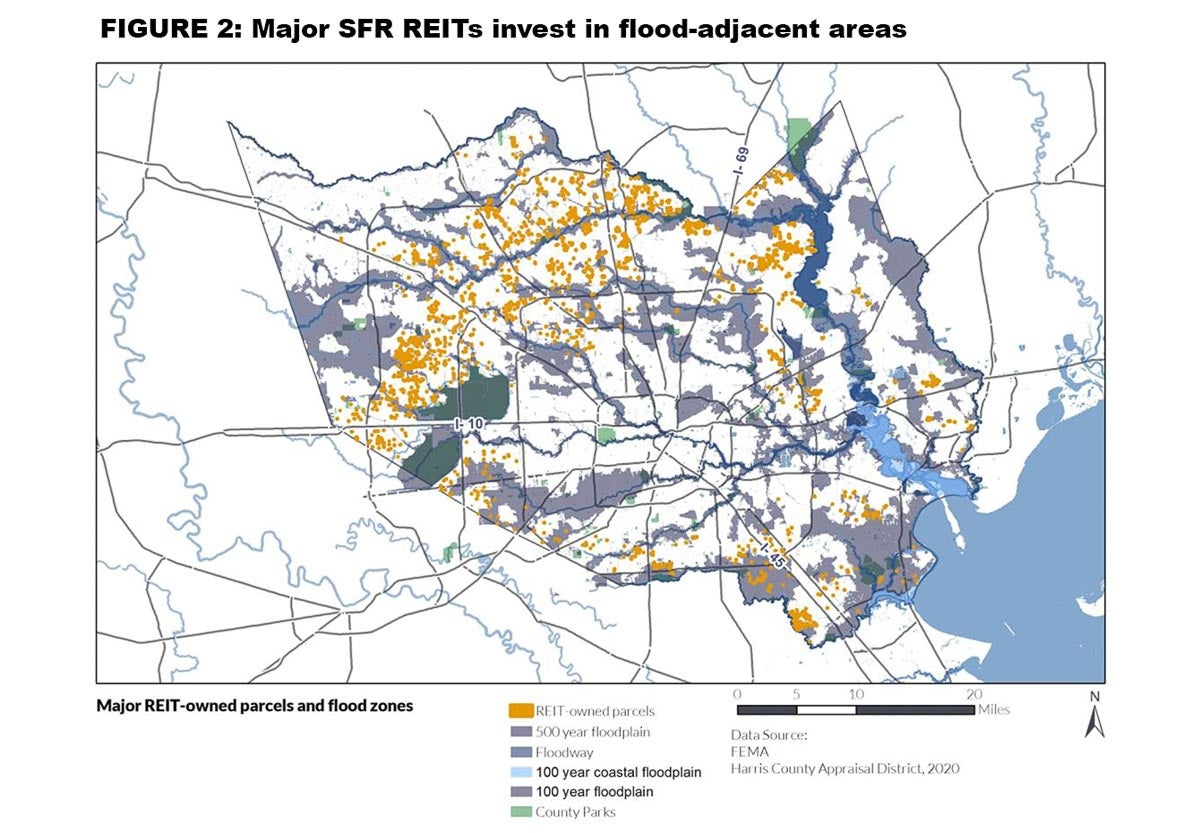

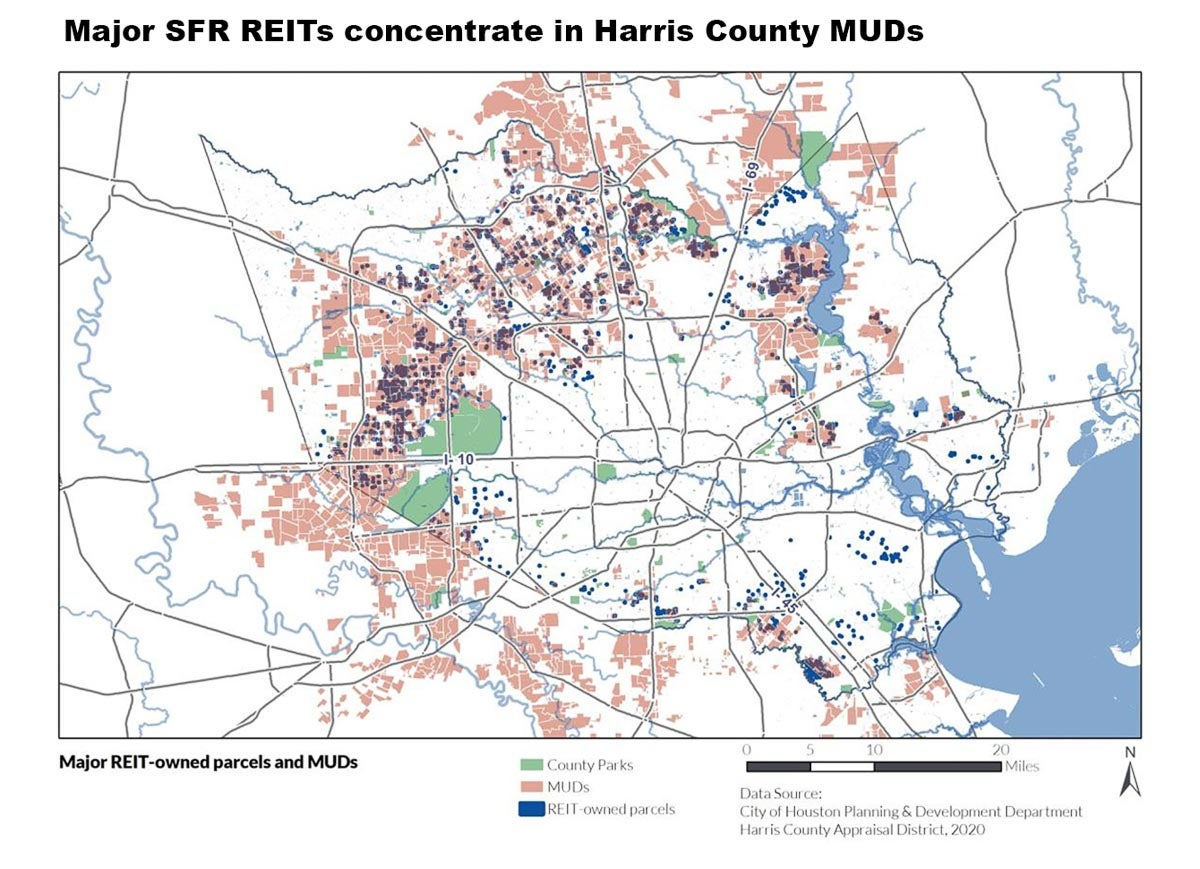

In this blog post, I draw on work I and other Kinder Institute researchers did for the recent report on the “State of Housing in Harris County and Houston,” focusing on the major national REITs that buy and rent out single-family homes in Harris County. We found that major REITs operate in the parts of the county hardest hit by foreclosures and in unincorporated parts of the county with many municipal utility districts (MUDs) and flood damage.

Single-family-rental REITs entered the post-foreclosure world as a service provider, one that maintains thousands of homes in high-foreclosure areas and rents them to tenants. Given that Houston is a majority-rental city (and Harris County a soon to be majority-rental county), our research raises important questions about our local landlords, their business practices, and the challenges to gaining knowledge on the rental industry.

Our recent work on REITs emerged from a simple question I had last December: Who are the biggest property owners in Harris County?

With help from our Urban Data Platform team, I acquired 2020 Harris County Appraisal District (HCAD) data on the 100 property owners with the most parcels.

The list, which you can see here, draws verbatim from HCAD records. It’s relatively inscrutable. While the three largest property owners are public-sector entities, the Top 100 list mostly contains limited liability corporations (LLCs) and limited partnerships (LPs). The first non-corporate “human name” to appear is at No. 44 (“PFIRMAN RICHARD L,” 311 properties), and it is the only “human name” in the top 100.

Who are these companies, and why are so many names so strange? The 9th largest property owner in the county, “CERBERUS SFR HOLDINGS LP” (952 properties), appears to be named after the three-headed dog that guarded the entrance to Hades. Other names read like a code, such as “SRP SUB LLC” (770 properties) or “TAH 2016 1 BORROWER LLC” (588). There are also some likely errors: “CURRENT OWNER” is the 4th largest property owner in Harris County.

This LLC structure makes it difficult to know who actually owns the property, as the whole purpose of starting an LLC is to limit liability. Not knowing the owning corporate entity raises problems for policymakers, especially when dealing with disaster resilience and recovery, a time when the not-for-profit and public sectors must try to connect landlords to recovery aid. This inscrutability also means that policymakers have a difficult time understanding the reach of the occasional unethical landlord, as that landlord can have their holdings under multiple LLCs.

The best tools available to us for learning details about property ownership are corporate record resources like LexisNexis and OpenCorporates. I searched corporate records on each of the county’s top 100 owners and cross-referenced the addresses of these LLCs and LPs with the corporate addresses of larger companies. Many ownership entities appear to be part of major local and national builders, such as Camillo Homes, Lovett Homes or Meritage Homes (which has 1,112 properties and is the largest private, non-utility property owner in the county).

Sometimes LLCs — often those with the most inscrutable names—shared addresses with the headquarters for major single-family rental REITs. Among the REITs in Harris County’s top 100 list are Invitation Homes, American Homes for Rent, Front Yard Residential and Tricom. These companies, some of which are traded on the New York Stock Exchange, have two major sources of revenue: rent checks from their tenants and sales of rental-backed securities issued on the projected rent income from their properties.

(If “rental-backed securities” reminds you of the mortgage-backed securities that helped precipitate the 2008 crisis, you’re not wrong to make that association. The very important difference is that single-family rental REITs, despite their growth, make up only 2% of the national single-family-home rental market).

For the 2021 State of Housing report, we emphasized that Houston is a majority-renter city (60% of households rent, according to 2019 1-year American Community Survey data) and Harris County is soon to be a majority-renter county (currently, 47% of households and growing). The share of single-family, stand-alone home rentals in the county has grown quickly, from about 125,000 households in 2010 to 170,000 in 2019. Harris County follows a national trend of growth in single-family rentals that has been documented elsewhere.[i] While the phrase “rental property” may invoke a large multifamily complex, it’s growingly also single-family homes with two-car garages.

A growing renter population means we should know something about all landlords, namely, their diverse business plans and their new (and emerging) corporate structures. These are the entities that house a majority of Houstonians.

REITs constitute a noticeable share of local landlords. Single-family-rental REITs gained in size after the 2008 financial crisis. Their long-term business plan entails acquiring homes at a discount (sometimes at foreclosure auctions), often using proprietary data management platforms to identify rentable homes with high amenities and value growth potential.[ii] The REITs then rent the homes and eventually re-sell them once they reach a marketable price. Many major single-family-rental REITs focus on Sun Belt metropolises, like Houston, because homes are expected to appreciate more in the long term than in Rust Belt metro areas.[iii]

REITs create controversy. Industry advocates argue these companies had the uniquely large resources to acquire foreclosed homes and thus prevent blight after 2008.[iv] Yet a wave of recent research finds that single-family-rental REITs are faster to evict late tenants than smaller landlords.[v] Journalists suggest these large companies “crowd” owner-occupiers out of the home purchase market (Dezember 2021): REITs have the assets to secure lower interest rate loans and can simultaneously pay more on the asking price while paying less in the long term.

There are barriers to understanding REIT activity in Houston. As stated above, HCAD records are obscure, so it’s extremely labor-intensive to link diverse LLCs names to specific real-estate investment trusts in a systematic manner.

Therefore, for the REIT section of the State of Housing, we restricted our search to the two biggest single-family-rental REITs: Invitation Homes (part of the Blackstone Group) and American Homes 4 Rent. Invitation Homes is arguably the largest homeowner in the country (Curry 2018), while American Homes 4 Rent is another large REIT with a sizable presence here.

American Homes 4 Rent employs a relatively standard naming convention for its LLCs in Harris County, using “AMH” followed by a year. This makes them easy to search in HCAD property records. Invitation Homes has no discernable convention for its LLCs, and I was only able to identify 4 LLCs linked to the company’s headquarters in Dallas. There are certainly more, but extensively searching LLC records cannot easily be done without access to LexisNexis proprietary databases.

Per our findings, these two companies own at least 3,075 properties in Harris County alone; there undoubtedly are more, but these are linked to the 12 LLCs that Kinder Institute staff could confidently link to the two companies. (I can provide the list of the 12 per request.) Furthermore, a group of researchers at Georgetown University and elsewhere created a database on corporate landlord holdings in major U.S. metros.[vi] In 2019, for the entire Houston metropolitan area (including and beyond Harris County), researchers estimated there were 5,485 single-family homes owned by these two companies.

Mapping these properties makes their business patterns clearer and evidences their geographic reach. The Georgetown-based estimate does not include spatial data; therefore, we map only the 3,075 properties identified within Harris County alone.

First, these companies’ properties are almost entirely beyond Beltway 8. Their business model does not entail acquiring properties within stronger gentrifying markets in central Houston.

Second, the major single-family-rental REIT properties tend to concentrate in areas with a lot of foreclosures. These two REITs own many properties in Atascocita and Bear Creek, high-foreclosure areas in northeast and west Harris County.

Kinder Institute for Urban Research

Third, these REITs concentrate their activities in areas with many Municipal Utility Districts (MUDs) and high flooding. Note the concentration of major single-family-rental REIT-owned parcels around Cypress Creek and in Bear Creek, two areas that Hurricane Harvey hit particularly hard. An important qualifier is that these maps only point to correlation, and not causation.

Kinder Institute for Urban Research

Kinder Institute for Urban Research

This correlation, however, still suggests the need for further research on the relationship between flooding, public-sector flood preparation, home foreclosure and REITs. MUDs are a unique local government structure mostly in unincorporated Harris County. They have many financial challenges, a point emphasized in past Kinder Institute research.

One causal hypothesis, which may be tested by an enterprising researcher, is that MUDs lack the resources needed to plan for local flood protection. When MUDs flood, the flood damages homes and increases homeowners’ financial stresses, which leads to foreclosure. In turn, REITs purchase the foreclosed homes.

More research can answer other questions. Our data in this analysis come from October 2020. The home sales market has strengthened since then, which would hypothetically entail these major single-family-rental REITs selling their rental homes to owner-occupiers at a high profit. Or, they may be selling to other REITs, a phenomenon suggested by some local housing advocates.

To conclude, the growth of single-family-rental REITs appears closely linked to the foreclosure crisis. The foreclosure crisis (and foreclosures in general) not only created foreclosed homes, but also forced the people living in those homes to enter the rental market. Beyond “just” making the homeowner homeless, a foreclosure also decimates the former homeowner’s credit score, which jeopardizes their future lease applications and balloons interest rates on future car loans. Foreclosure makes it harder to live, period, especially in a car-centric metro area like ours. It also means that more people are trying to get leases in our rental-majority city.

[i] Ryan Dezember, “If You Sell a House These Days, the Buyer Might Be a Pension Fund,” Wall Street Journal, April 4, 2021, sec. Markets, https://www.wsj.com/articles/if-you-sell-a-house-these-days-the-buyer-might-be-a-pension-fund-11617544801.

[ii] Desiree Fields, “Automated Landlord: Digital Technologies and Post-Crisis Financial Accumulation,” Environment and Planning A: Economy and Space, May 1, 2019, 0308518X19846514, https://doi.org/10.1177/0308518X19846514.

[iii] Desiree Fields, Rajkumar Kohli, and Alex Schafran, “The Emerging Economic Geography of Single-Family Rental Securitization,” Community Development Investment Center (San Francisco, CA: Federal Reserve Bank of San Francisco, January 2016), https://eprints.whiterose.ac.uk/94673/1/SFR%20Working%20paper%20SF%20FED.pdf.

[iv] Kerry Curry, “How Invitation Homes Became the Biggest Owner of Rental Houses in the Country,” D Magazine, April 2018, http://www.dmagazine.com/publications/d-ceo/2018/april/invitation-homes-rental-dallas/

[v] Eric Seymour and Joshua Akers, “‘Our Customer Is America’: Housing Insecurity and Eviction in Las Vegas, Nevada’s Postcrisis Rental Markets,” Housing Policy Debate, November 9, 2020, http://www.tandfonline.com/doi/abs/10.1080/10511482.2020.1822903, finding REITs being more likely to quickly evict tenants; Elora Lee Raymond et al., “Gentrifying Atlanta: Investor Purchases of Rental Housing, Evictions, and the Displacement of Black Residents,” Housing Policy Debate 0, no. 0 (April 15, 2021): 1–17, https://doi.org/10.1080/10511482.2021.1887318, linking REIT purchases to higher evictions and faster neighborhood racial transition.

[vi] Corporate landlord residential unit database was a collaborative research project between Georgetown University Kalmanovitz Initiative's Bargaining for the Common Good (BCG), the Action Center on Race and the Economy (ACRE) and Americans for Financial Reform Education Fund for BCG's 2019 Housing Justice Convening. Numbers are conservative and based on publicly available information such as government filings and company websites, as well as calculated estimations from rental data.