At a recent Kinder Institute Forum, the Institute hosted Antoine Bryant, former Row House Community Development Corporation director and current head of the Detroit Planning & Development Department. (Subscribe so you don’t miss future forum events.)

I am not a Detroit expert, but I have read enough about the city to know about the city’s massive housing challenges. About 35% of the population lives under poverty, compared to 20% in Houston. The scale and scope of depopulation is arguably beyond that of any other major American city. Residents need housing investments to either fix older homes or build affordable, quality housing stock.

Yet every other question asked by forum attendees seemed to focus on gentrification in Detroit. I was puzzled, because the questions seemed non-sequitur. First, the city’s poverty rate remained level over the past 10 years, so one could argue people are not being forced from the city en masse in a gentrification process. Second, given the extent to which Detroiters cannot find even quality affordable housing, but also basic life necessities like clean water, trash pickup, or heat from their city, and that city’s suburbs and the state are stripping Detroit of the resources which deliver those services, gentrification seemed to be the most minor of problems.

While I don’t suggest there is no gentrification in Detroit (or here in Houston), I do think that a focus on gentrification may limit urbanists, planners and researchers from asking different questions about how private and public capital shapes cities. It also may limit our discussions to central parts of the city, ignoring interesting changes to the housing system happening farther from the metro center.

Let’s take things back to Harris County and Zillow’s failed iBuyer division.

iBuyers, REITs, and the suburbs

Zillow, famous for aggregating pictorial home listings and therefore giving us a new window into the breadth of human eccentricity, entered into the iBuyer business in 2018. iBuyers like Offerpad, RedfinNow, and Opendoor use algorithms to scour home listings and find flippable for-sale homes to buy, renovate, and quickly re-sell. Zillow already had its proprietary “Zestimate” and extensive data on home sales, so iBuying likely seemed a natural extension of its work.

But Zillow’s “buy in bulk and flip” model crashed and burned: Their iBuyer algorithms failed to account for changes in labor costs, difficulties in coordinating renovation logistics, and a slowing housing market. Having recently stopped buying new homes, the company decided to offload the iBuying sector. Earlier in November they agreed to sell 2,000 homes to Pretium Partners, an investment firm specializing in single-family home rentals.

Similar to the major REITs like Invitation Homes and American Homes 4 Rent, whose Harris County presence I analyzed in past research (as part of the State of Housing report), Zillow and other iBuyers tend to operate in Sun Belt metropolitan areas. In the Houston metro, Zillow hoped to sell 155 homes as part of its offloading. (As of now, we do not have the data to deduce if Pretium will have these Houston area homes).

I asked: Where are these Zillow and other iBuyer homes in Harris County? I used July 2021 HCAD records to identify Zillow, Redfin, Offerpad, and Opendoor properties within Harris County. I recognize that this analysis omits Fort Bend, Montgomery, Galveston, and other suburban counties whose recent assessor data Kinder does not possess. I identified LLCs we could confidently link to each company and mapped them. (See the LLC list here. If you identify one that you think we missed, tell me and I will update this blog!)

I identified (as of July 2021) 95 properties owned by Zillow in Harris County. Offerpad had 62, Opendoor had 233, and Redfin had 10. I want to emphasize this is likely an underestimate because there may be other LLCs we could not identify. For example: accessing redfin.com on November 12 and searching for Redfin-owned properties in Harris County showed me 63 homes for sale, meaning that my analysis is lacking certain LLCs, or that Redfin has purchased more homes since July 2021.

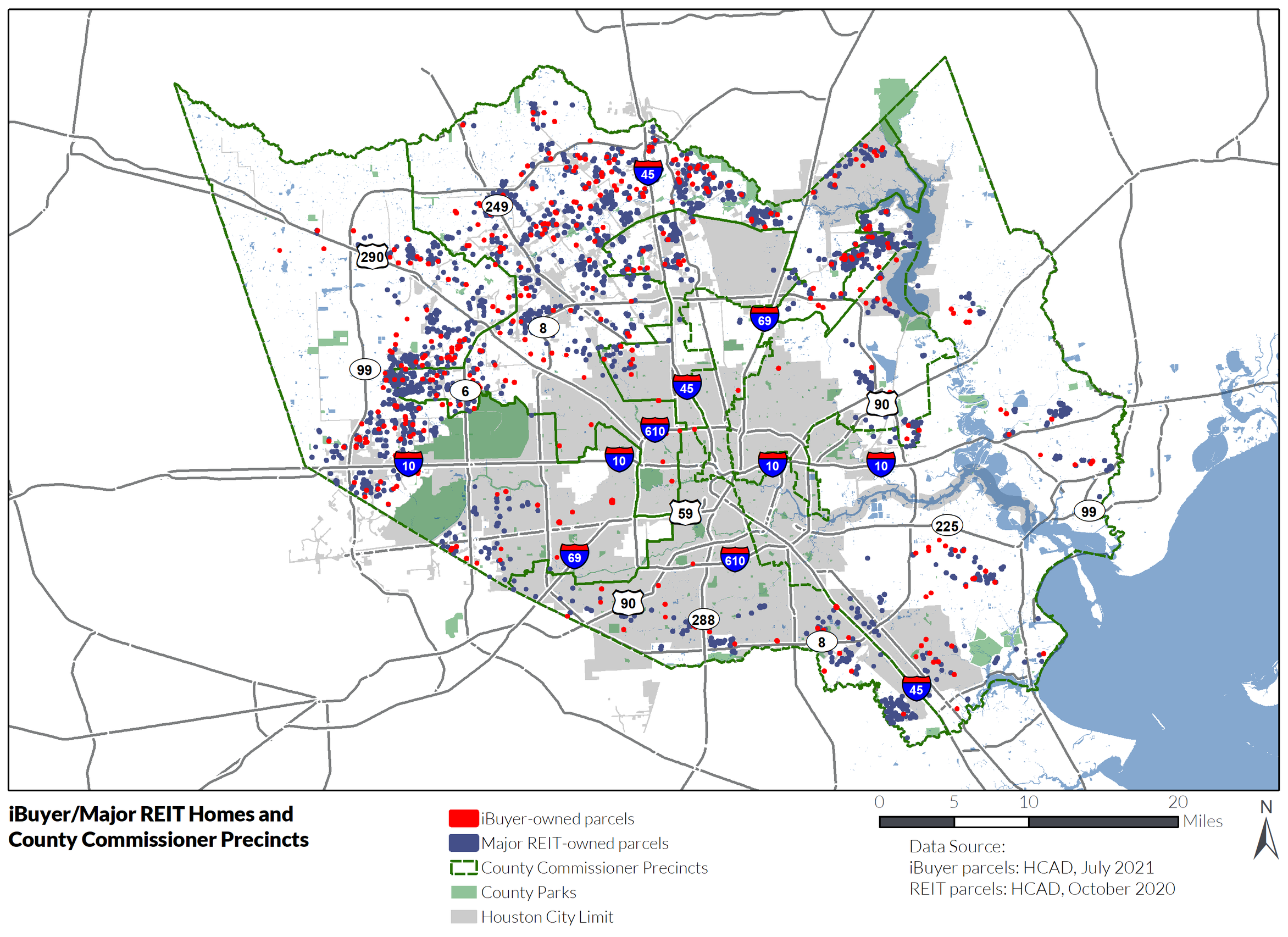

These iBuyer companies invest mostly in the county’s north and northwest. The geography is remarkably similar to the major REIT-owned properties we identified in analysis earlier this year, and I chose to map them together.

The Houston city limits appear repugnant to these investors, as almost all homes outside the city boundary. Many are within the (pre-2023) County Commissioner Precincts 3 and 4, currently represented by Tom Ramsey and Jack Cagle, respectively. (The precise precinct boundary count should be taken with a grain of salt, given how much boundaries are changing around the Cypress area which has many homes.)

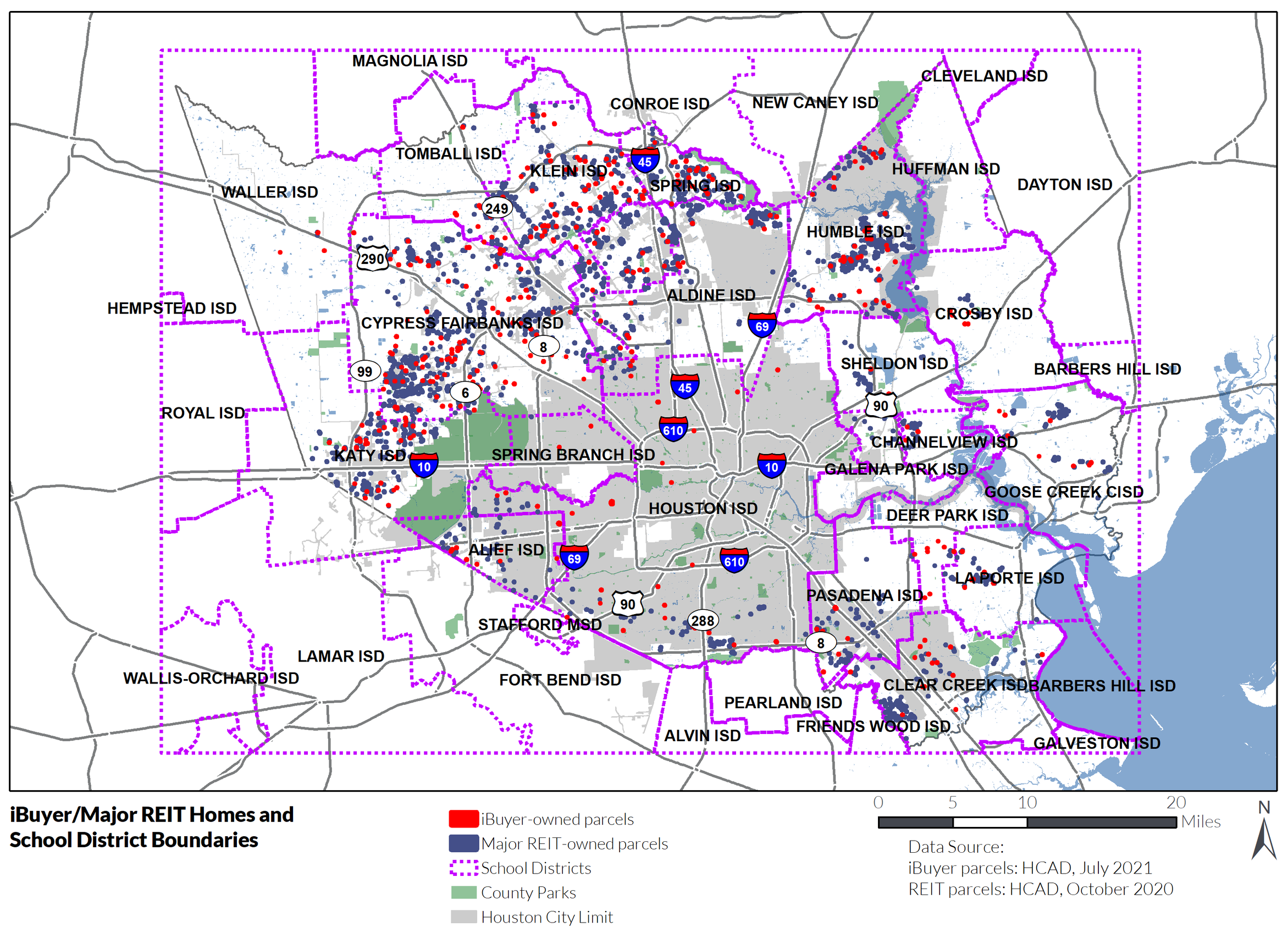

These home investors are not only avoiding Houston city limits, they are also avoiding Houston ISD. Those companies’ algorithms put a heavy weight on school district, and seem to have a bias against central city school districts. Cypress-Fairbanks has the most iBuyer and REIT properties by a relatively large margin (92 and 745, respectively). Houston ISD is by far the geographically largest of local school districts, yet contains few iBuyer or REIT homes.

One notices similar “ranking” between iBuyer and REIT home count by school district, but the pattern diverges in some interesting places, specifically the Sheldon and Aldine school districts. Both Sheldon and Aldine ISDs contain few iBuyer homes, but contain significant amount of Invitation Homes/American Homes 4 Rent REIT properties. Remember that REITs have a different business model than iBuyers: REIT often acquire foreclosed homes and rent them to tenants. Notably, Sheldon and Aldine had significant amounts of foreclosures (see Page 44 of State of Housing).

Whither gentrification?

Savvy housing investors flipping homes and renting foreclosed single families is not only something happening within central city areas with older homes, or even poorer areas. It’s also happening in places with “good schools”, high property values, and new homes.

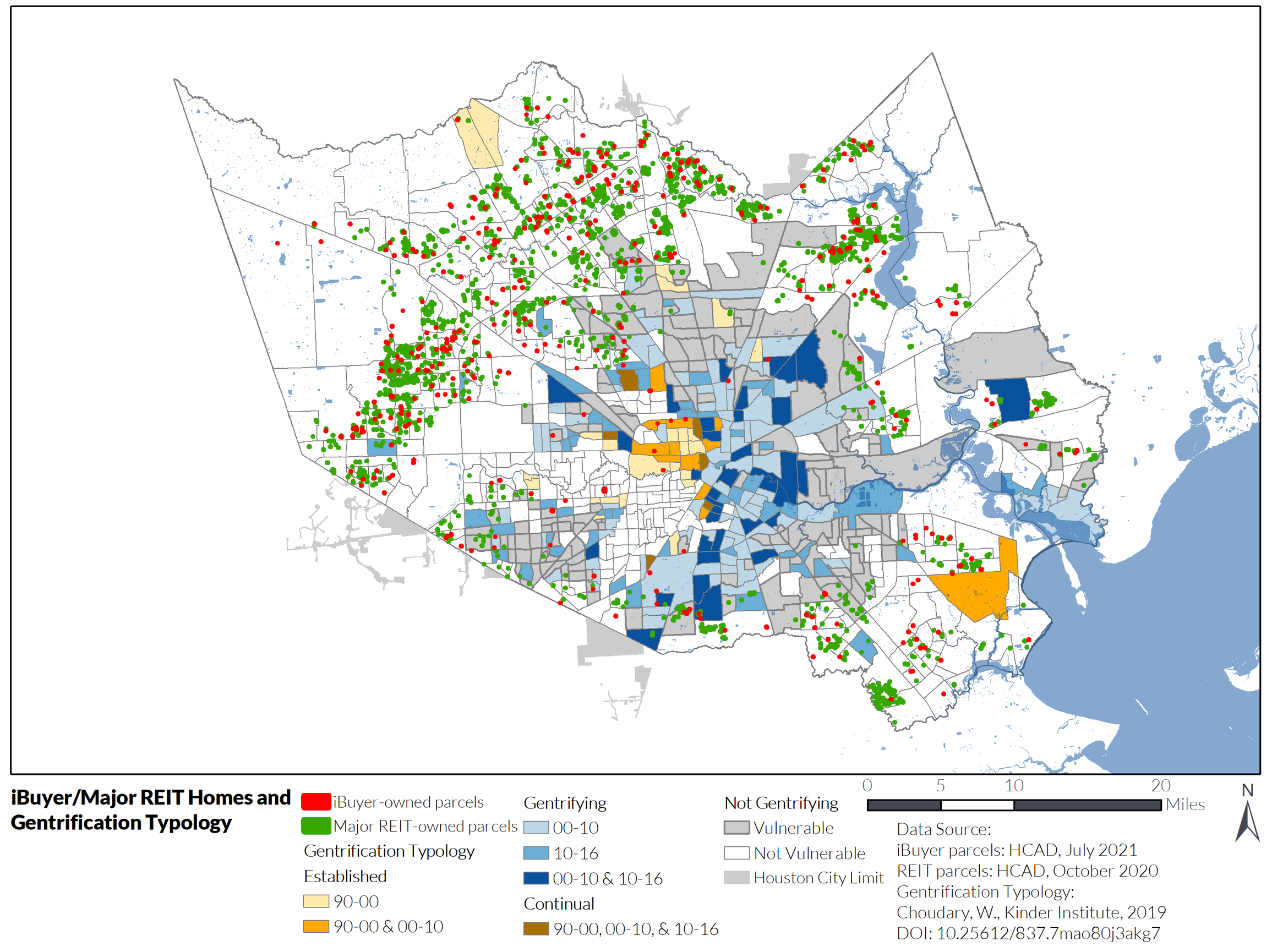

Kinder Institute’s recent research on gentrification and gentrification susceptibility in Harris County identified past gentrification trends, and predicted which places countywide are likely to gentrify in the future.

Your Zillows and Invitations Homes of the world do not invest in homes in gentrifying areas. Their properties are almost totally outside the gentrifying and gentrification-susceptible geographies of Harris County. The sole exceptions are small concentrations of parcels near Beltway 8 around the metro area.

Algorithms and investors: looking outwards and onwards (beyond gentrification)

Geographer Neil Smith famously called gentrification a back-to-the-city movement of capital, not people. The opposite appears to be happening with iBuyers and REITs, which are funneling investment capital to suburban areas, not central-city housing markets.

This suburban strategy may be a relic of these firms’ decision-making process, and particularly the use of algorithms.

Let me explain: In the thoroughly gentrified neighborhood where I live (Museum Park), I live in an older but renovated apartment building with central air and new appliances. Within just a two-block radius of my apartment are two large 50+ unit highrises built within the past 5 years, an older single-family home without major renovations, some refurbished older homes with significant renovations (and I imagine newer bathrooms and built-ins), and of course many newer infill townhomes of very different design, height, and building quality.

Yet in places like Cypress there are whole square miles of relatively uniform 4-bedroom homes with attached garages. These homes, which have similar floor plans, have not aged long enough to have significant additions or renovations.

This makes predicting home sale prices in Cypress a lot easier, and apt for analysis by a machine-learning algorithm. There are many comparative home sales that programmers can feed into an algorithm as training data, in order to make a more accurate sales estimate and inform investment decisions. In gentrifying urban core areas, investing requires block-by-block knowledge, a wider range of decisions, and a sense of residents’ preferences and tastes. That means you need someone on the ground, not just a programmer in Seattle. The REIT/iBuyer model is not only a different way of doing real-estate investment, it is also a different way of doing real-estate labor, one which follows a global trend of saving labor costs through artificial intelligence.

As large out-of-state real-estate investors possess both stronger AI programming knowledge and a growing surplus of capital to invest, REITs, iBuyers, and similar models will grow and remain important entities to track for anyone concerned with housing policy. REITs are not a large section of the single-family rental market yet, but they are growing. One in 6 homes are purchased by an investor. While Zillow’s iBuyer division appears to have tanked, Opendoor and Offerpad are still going strong. What will this mean for suburban communities and their school districts’ enrollment, their homes’ long-term upkeep, and their housing life cycle? Will out-of-state real-estate investment now turn away from the central city? Will suburban investor-builders turn away from owner-occupiers and towards renters? All of these are important questions, so if we narrowly needle over central city gentrification, we may miss the bigger picture.