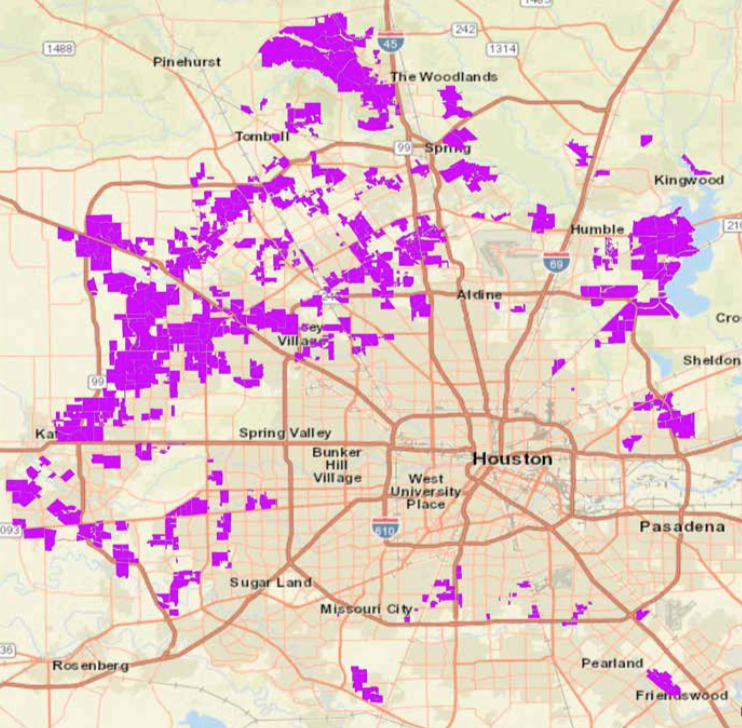

Municipal utility districts, or MUDs, are not unique to Houston but the region certainly made them its own over the course of the region's development. Harris, Fort Bend and Montgomery counties have 70 percent of all the MUDs in the state. The special districts are, in part, responsible for Houston's sprawling form. They also help make up a patchwork system of governments that, according to a new report from the Kinder Institute, presents long-term challenges for the financial health of the region and that delivers uneven services to neighborhoods often depending on their relative wealth.

The districts are formed to collect property taxes that are used to reimburse subdivision developers for their upfront, infrastructural investments. Then, the MUD tax revenue is used over time to pay off bond debt, maintain major systems like water treatment plants and can also be used to make other community improvements. Though MUDs were never intended to act as general purpose governments, they have essentially come to fill that role, particularly as the City of Houston has slowed its once prolific annexations. At the same time, the report notes, because many of these MUDs sit inside Houston's extraterritorial jurisdiction—which includes some 500 government jurisdictions with the special districts—they're unable to incorporate on their own without Houston's permission.

Between the county, cities and MUDs, each entity faces some funding challenges. So city residents pay county taxes, for example, but the county rarely invests "equal amounts of funding for infrastructure and service provision back into cities," the report explains. At the same time, cities, through limited purpose annexations, are able to collect some sales tax from MUDs but don't generally then provide services in those MUDs. And the counties, meanwhile, particularly fast-growing, urban ones like Harris County, face revenue and statutory limitations that make it difficult to provide an "urban level of services" to residents in built-up but unincorporated areas.

The system has also created other issues, the report notes, including uneven services across the region as both annexation and the use of special districts have often overlooked low-income areas. "Lower-income, unincorporated areas that are not part of a city or special district face obstacles to improving infrastructure without access to additional revenue," the report concludes.

Source: Kinder Institute.

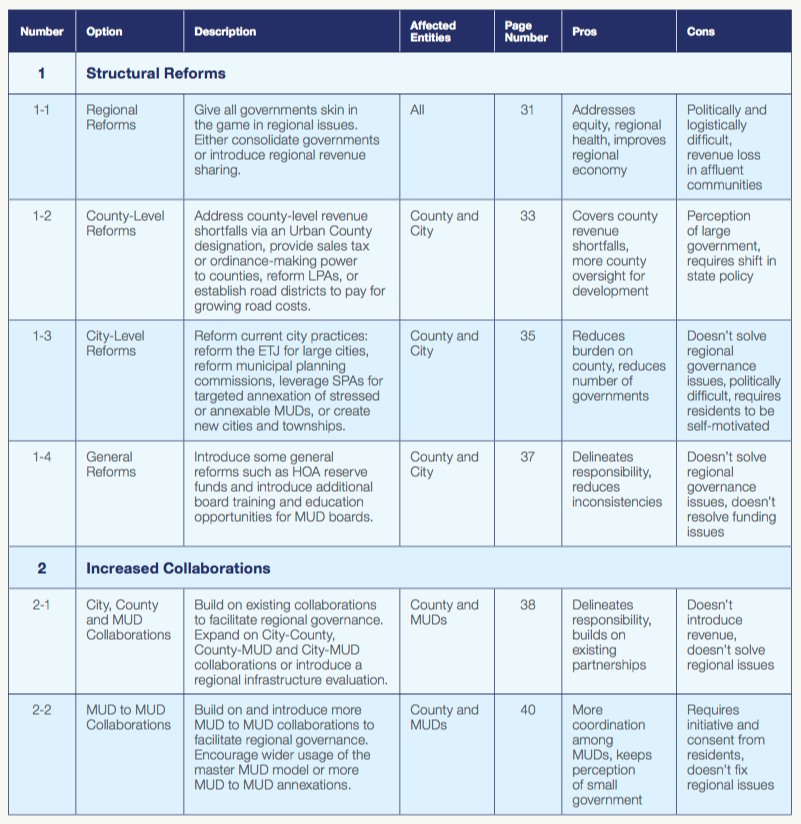

Making the system work better for all residents is a tall order but the report outlines a number of options for reform, including the implementation of a regional revenue sharing scheme that could help fill gaps and ensure regional prosperity. That was the approach taken by the Twin Cities Metropolitan Council when it created its Minneapolis-St. Paul Fiscal Disparities Program roughly 40 years ago. The array of cities, townships, school districts and other taxing entities across the seven-county region agreed to pool and share 40 percent of the increase in their commercial-industrial tax base, according to the report case study (also examined further in another Urban Edge piece). Overall, the report notes, more communities ended up gaining under the sharing system than they gave, but it also notes that, over time, the communities considered either donors or recipients have shifted, suggesting that the model helps adjust for changing growth dynamics.

Other reforms detailed in the report include giving counties ordinance-making powers, giving urban counties sales tax power and raising the sales tax cap and finding opportunities for increased collaboration.

"The experience of Hurricane Harvey highlights the fact that infrastructure and service provision issues are regional in nature, not local," the report concludes. "The current system, with its dependence on MUDs covering small geographical areas, has helped facilitate additional growth in the past few decades," but, the report continues, "[r]eforms to the system, however, will ensure long-term stability so that all residents of the Houston region, not just those inside cities and MUDs, are able to benefit from high-quality infrastructure and government services."