Many saw the Democratic midterm gains in the statehouse as a signal that voters are interested in "things that matter," as one representative put it, rather than the sorts of bills and rhetoric that have dominated recent conversations. Instead, lawmakers said the results underscored a desire to focus on things like property taxes and school funding. A new University of Texas/Texas Tribune poll conducted in February confirmed that but an open-ended question suggested voters had other concerns as well.

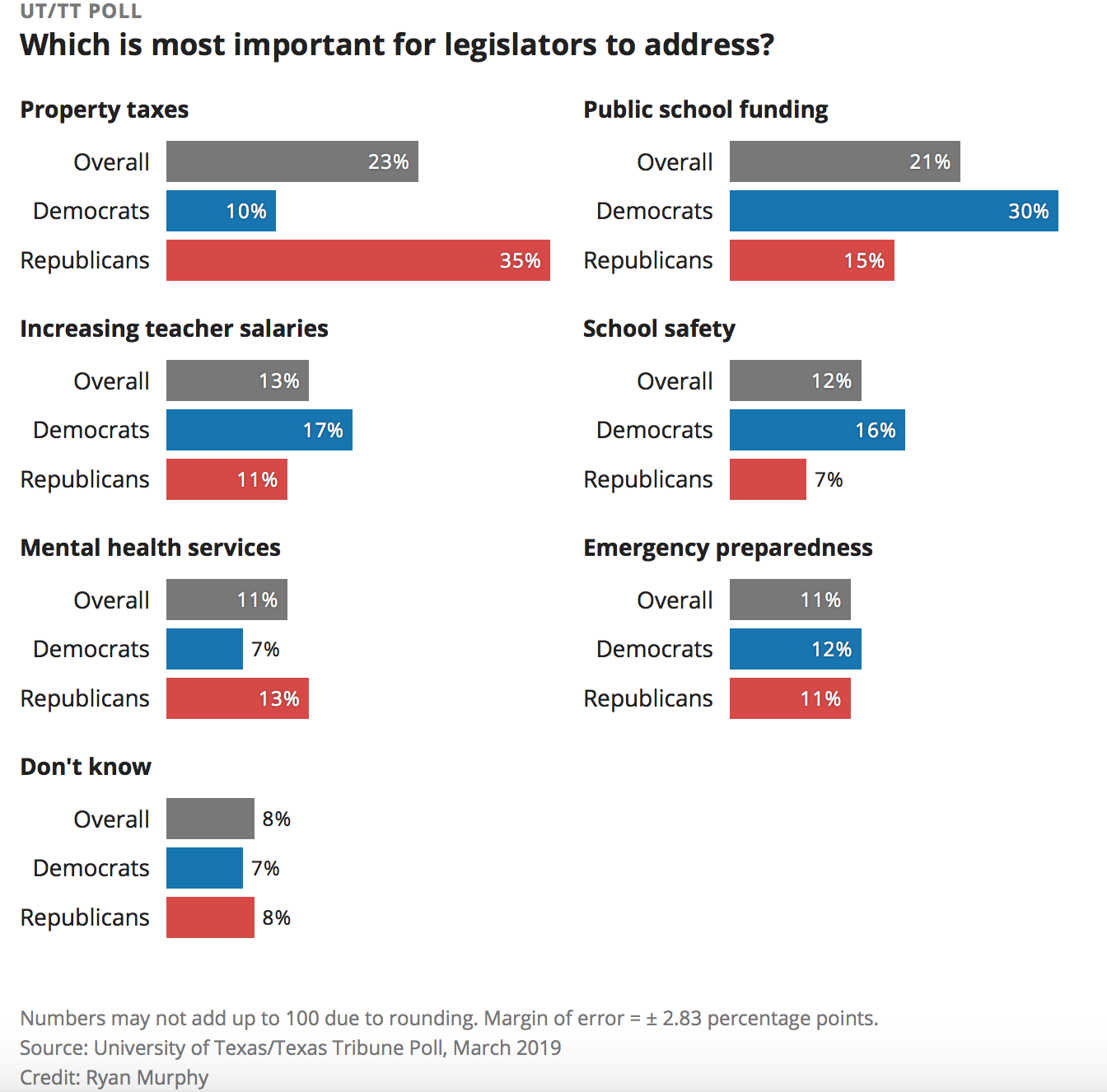

Just under a quarter of Texas voters said property taxes represented the most important issue for legislators to address, while 21 percent said the same for school funding. Increasing teacher salaries, school safety, emergency preparedness and mental health services were also among the top issues named.

While property taxes and school funding received the most overall concern for voters, there were partisan divides both about the urgency of the issue. Just 10 percent of Democrats said property taxes were a top concern compared to 35 percent of Republicans. When it came to school finance, 30 percent of Democrats put it as a top issue while 15 percent of Republicans did.

More common ground could be found for teacher salary increases and emergency preparedness.

Numbers may not add up to 100 due to rounding. Margin of error = ± 2.83 percentage points. Source: University of Texas/Texas Tribune Poll, March 2019. Credit: Ryan Murphy.

But the numbers looked a little different when respondents were asked about their priorities in an open-ended question: "23 percent listed immigration or border security, followed by education (14 percent), health care (7 percent) and property taxes (6 percent)," according to the Texas Tribune.

“It’s interesting that property taxes didn’t come up more frequently, given the narrative that it’s what leaders say they are hearing about [from voters]. At the same time, it speaks to the salience that immigration and border security just consistently hold for Republican voters,” Josh Blank, manager of polling and research for the Texas Politics Project at UT-Austin told the Texas Tribune about the results.

“It also shows you there are a lot of people not paying attention to the legislative session right now,” Blank continued. “But if you limit the question to what lawmakers are working on right now, public school funding, property taxes and teacher pay raises are a pretty good set of issues.”

Indeed, the Senate passed a bill Monday that would give teachers across the state "an immediate financial boost," according to Lt. Gov. Dan Patrick, who has promoted the bill. The bill promises $5,000 in pay raises for full-time teachers and librarians, representing some $4 billion over the next two years. Amid strikes across the country, teacher pay was named one of Gov. Greg Abbott's emergency items in February.

Others have pushed for merit-based raises or more flexible grants for districts on the one hand, or smaller increases that would include more school personnel on the other.

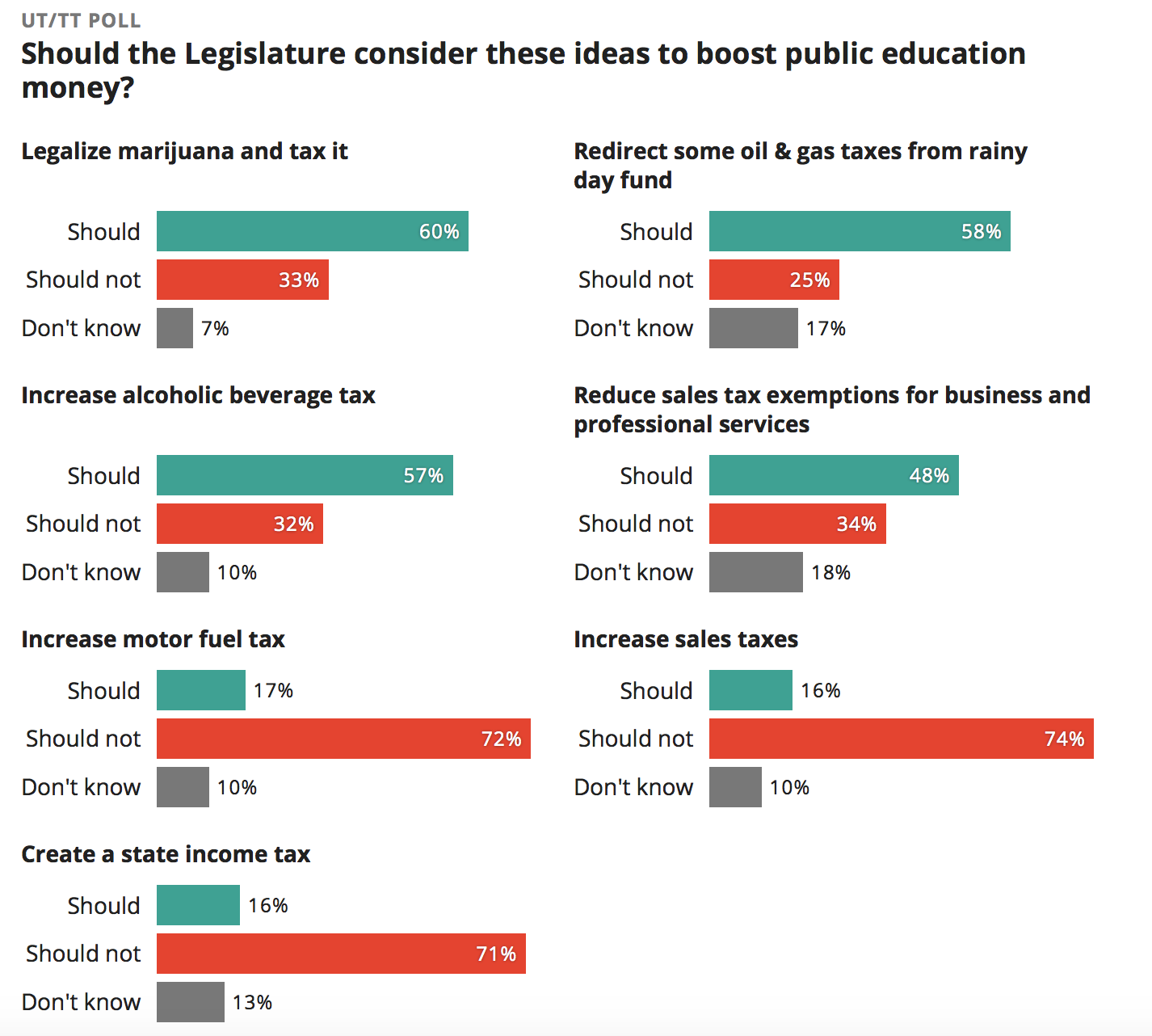

When it comes to the larger question of school funding reform, voters were most supportive of legalizing and taxing marijuana, followed by diverting oil and gas tax dollars from the rainy day fund for education. Likewise, a strong majority rejected the idea of increasing gas or sales taxes or creating a state income tax to supplement education spending.

Numbers may not add up to 100 due to rounding. Margin of error = ± 2.83 percentage points. Source: University of Texas/Texas Tribune Poll, March 2019. Credit: Ryan Murphy.

In a bill filed Tuesday in the House, Rep. Dan Huberty unveiled a plan that would add $9 billion "above enrollment growth & current law entitlement over the next two years," according to the bill's own website, that would boost the base allotment possible per student, not including weights, to $6,030. The bill also ensures full-day pre-kindergarten for eligible four-year-olds, though districts could apply for waivers.

"It would also lower school district property tax rates statewide by 4 cents per $100 of taxable property value," according to the Texas Tribune, representing a roughly $100 cut in taxes for homeowners with a taxable value of $250,000.

"That method of property tax relief is different than one proposed by Gov. Greg Abbott last year," write Texas Tribune reporters Aliyya Swaby and Cassandra Pollock, "which would cap annual increases in school districts' tax revenues at 2.5 percent."

The bill also took a different approach to potential raises than the Senate, arguing for more discretion at the local level.

At a press conference Tuesday, Huberty argued that the bill delivered both needed school finance reform and tax property relief. "This is transformative," he said.

"This absolutely marks the moment we get to make the changes we've all talked about," added Rep. Diego Bernal, who emphasized the bill's focus on boosting dual-language programming and funding that supports "schools that are surrounded by generational poverty."

Houston-area Rep. Alma Allen added, "These additional resources make a huge difference to teachers and students."

The lawmakers stressed the bill was a work in progress and part of a larger set of bills aimed at school funding. "While this is not perfect," said Huberty, "it provides meaningful reform."