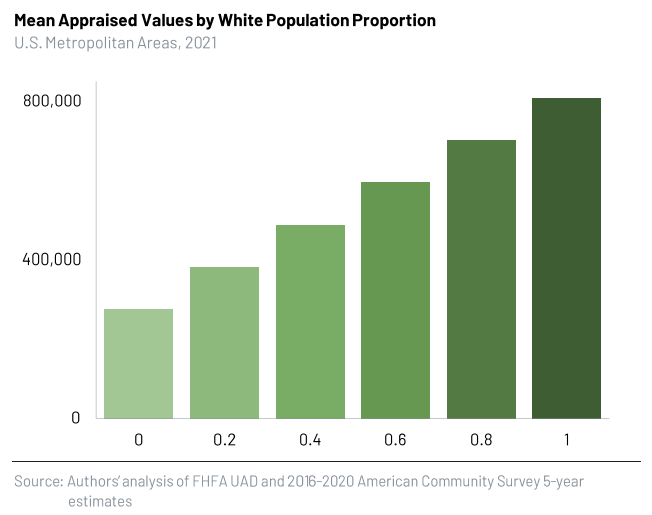

Homes in white neighborhoods are assessed at double the value of comparable homes in communities of color, according to a report analyzing newly released government data on appraisals.

The report’s findings show that rather than improving over time, racial inequality in residential appraisals has worsened over the past decade. The imbalance was heightened during the pandemic, especially in the country’s hottest housing markets, as loose monetary policies allowed for low-cost mortgages to flourish and home values to skyrocket.

“It really just exacerbated the rate at which these broader trends of racial inequality in appraisals have accelerated,” said Elizabeth Korver-Glenn, assistant professor of sociology at Washington University in St. Louis, who co-authored the report with Junia Howell, a visiting associate professor of sociology at the University of Illinois Chicago. (Both are former Kinder Scholars.)

The researchers analyzed trends in 105 markets, including Houston, where the average appraised value of a home in communities of color was $257,049 in 2021, while in white neighborhoods it was $543,716—a gap of more than $286,000.

Among the report’s findings:

- By comparing similar homes in neighborhoods with the same socioeconomic status and comparable amenities, homes in white neighborhoods were valued $371,000 more than their counterparts in communities of color.

- The neighborhood racial gap in appraised values increased by 75% — or $157,000 — from 2013 to 2021.

- During the pandemic, appraisers increased their valuation of the average-size and average-age home in a white neighborhood by $136,000, compared to $60,000 for the same house in a community of color.

- Racial inequality is growing nearly three times faster in the hottest housing markets compared to stable markets.

- Appraisers evaluate homes owned by Indigenous, Pacific Islander and Southeast Asian people as the least valuable across communities of color.

View the full report.

An appraisal is a key component of the homebuying or refinancing process. Mortgage lenders typically require a third-party valuation to determine a home’s worth. A low appraisal can reduce a home’s market value and affect how much money a bank will lend on the purchase of that home. (This is different from the assessed value that is generated by appraisal districts for tax purposes.)

Racial inequalities have long plagued the U.S. housing market and contribute to the racial wealth gap.

Unfair appraisals and bias in housing have led to a practice called “whitewashing,” where homeowners of color remove family photos and any other evidence that they own the home before showing it to an appraiser or prospective buyer. Homeowners of color have shown documented accounts of receiving higher appraisals when they remove their personal items.

Fair housing agencies and advocates have been calling for more transparency in appraisal data to address the crisis.

Last year, the federal government created a task force to study appraisal bias and develop a plan to reform the appraisal system. One of the reforms put forward in the Property Appraisal and Valuation Equity (PAVE) study called for the development of a federal database to better research and address appraisal bias.

Howell and Korver-Glenn’s new report is based on appraisal data that was released by the Federal Housing Finance Agency (FHFA) last week, the first time this was made available to the public. The agency used more than 47.3 million appraisal records collected from 2013 through the second quarter of 2022 on single-family properties to create a file of aggregated statistics that protects borrower privacy. Each record includes information reported by appraisers on the standard industry valuation form.

The business of valuing properties has operated in a historically racialized system, as appraisers have been trained to determine a property’s worth based on past sales going back to a time when processes ensured white properties remained the most valuable, according to the report.

And even though federal law forbade racial, religious and other discrimination in home appraisals some 50 years ago, the system remains flawed, the researchers said.

“The way they justify the values they arrive at for individual homes is drawing on past sales of other nearby homes … when that system of racist and classist appraisal was still in place,” Korver-Glenn said.

The report proposes two key action steps: reparations through targeted tax credits or stimulus programs and a new appraisal approach that does not rely on past sales.

“It’s really important to recognize that if we don’t change current methods, even if we did reparations,” Howell said, “we’d get right back to where we are because our methods are creating a problem.”

Nancy Sarnoff, a longtime Houston business and real estate journalist, is a contributing writer for the Urban Edge.