To get built, these housing projects must go through an extensive application process and receive local and state approval. However, LIHTC properties are not permanently affordable; they typically have expiration dates that signal the end of their affordability status. In just five years, over 4,000 such units in Harris County could lose their status. This means preserving existing tax-credit housing will be just as important as building new units as the region continues to grow.

Housing Foundations is an Urban Edge series explaining the policies, systems and historical context behind the housing challenges facing Houston and other large metros. This post focuses on the low-income tax credit program and its role in Harris County.

What is the Low-Income Housing Tax Credit?

Unlike other housing initiatives, the LIHTC (pronounced “lie-tech”) program is not administered by the U.S. Department of Housing and Urban Development (HUD); rather, it is a provision in the Internal Revenue Code issued by the Department of the Treasury and the Internal Revenue Service.

The program was established by the Tax Reform Act of 1986 and allocates approximately $10 billion annually to state and local agencies for issuing tax credits. Between 1987 and 2022, the program facilitated the development of 56,032 projects nationwide, resulting in 3.65 million housing units specifically designed for low-income households, defined as those earning up to 80% of the area median gross income.

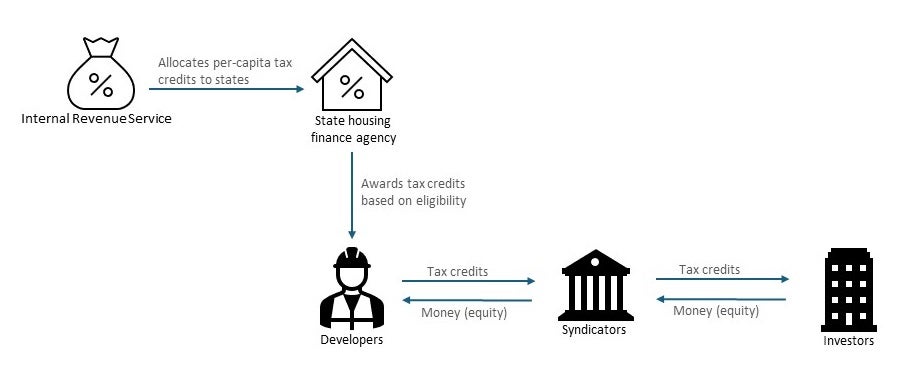

The federal government requires states to set up an agency to administer the LIHTC program and allocates per-capita tax credits to those agencies based on population. The state agencies then distribute these credits to private developers of affordable rental housing through a competitive selection process. Annually or biannually, this department publishes a Qualified Allocation Plan (QAP) detailing the requirements for LIHTC applications.

The state LIHTC allocating agencies allocate 9% (competitive) or 4% (noncompetitive) tax credits to both for-profit and nonprofit private developers. Typically, the 9% credit provides more equity to the project, and developers compete for the credit based on the QAP. In contrast, the 4% credit provides less equity and is noncompetitive, meaning developers do no need to compete for it.

How does it work?

The LIHTC program enables investors to reduce their federal income taxes by $1 for every dollar of tax credit received. These tax credits are available for 10 years, during which time low-income households must occupy the property according to specific affordability guidelines.

Initially, federal regulations required developers to uphold affordability for a minimum of 15 years, known as the initial compliance period. However, as of 1990, all new LIHTC properties must maintain affordability for 30 years. After this timeframe, LIHTC owners can seek regulatory relief to transition their properties to market-rate units.

Some states enforce longer affordability obligations, and certain LIHTC projects might have local financing that includes additional use constraints. In Texas, developers agreeing to a longer compliance period (35 to 45 years) for 9% LIHTC projects receive extra points in the application process. In other words, the Texas Department of Housing and Community Affairs (TDHCA) promotes longer periods of affordability for LIHTC projects through the use of the QAP.

Typically, as seen in the figure below, housing developers do not take advantage of LIHTC directly; instead, they sell the credits to private investors to help finance development-related expenses. Developers may sell these credits directly to individual investors, or more commonly, they partner with syndicators — either for-profit or nonprofit organizations that sell shares in tax-credit developments to corporations and other investors.

The value of tax credits does not consistently equal $1 per credit and varies by market conditions. For instance, in 2006, the price was around $1 per tax-credit dollar, while by 2009, it had decreased to 80 cents per dollar, reflecting the impact of the financial crisis from 2007 to 2010.

What does LIHTC look like in Texas?

In Texas, the TDHCA oversees the tax credit program, which it calls the Housing Tax Credit (HTC). As part of its project review process, TDHCA requires public hearings for the 9% HTC projects to allow local governments and stakeholders — such as city councils, county commissioner’s courts, neighborhood associations and state representatives — to provide input by submitting comments.

In particular, state law mandates letters expressing support, neutrality or opposition from state representatives. This requirement often becomes a tool for NIMBYism (“not in my backyard”), where neighbors oppose new developments in their communities and pressure their local representatives and government officials to follow suit. Within the context of affordable housing, NIMBYism is often fueled by fears of adverse effects on property values, crime rates, traffic and educational quality. Nonetheless, research shows that such developments typically have positive or neutral effects on the surrounding neighborhoods.

Following the 2019 Analysis of Impediments to Fair Housing Choice, TDHCA addressed these NIMBYism-related issues by creating a workaround allowing applicants to get full points with a local government resolution instead of a state representative letter. In Houston, the city council holds a vote on endorsing proposed developments within city limits. However, political viability still remains a challenge, with only two applications securing an award from 2018 to 2023.

TDHCA mandates that at least 20% of a project's units must be rent-restricted and occupied by tenants with incomes at or below 50% of the Area Median Family Income (AMFI). Alternatively, developers can designate at least 40% of the units for tenants whose incomes are 60% of AMFI or less. In 2018, an average income test was introduced: While HTC projects can accommodate households earning up to 80% of AMFI, at least 40% of the residential units in the project must both be income- and rent-restricted, averaging at or below 60% of AMFI.

Although only 20% of units must be set aside for eligible tenants as a minimum, developers often reserve between 60% and 100% of the units for eligible tenants to improve their score and secure a larger allocation of housing tax credits. Properties with HTC units may have market-rate rental units as well, but housing tax credits can only be claimed for the “affordable” units that are set aside within the property.

What about Harris County?

Income requirements and rent limits for HTC units are established annually by HUD and vary by household size and number of bedrooms (Tables 1 and 2). For example, in Harris County, a family of four earning 50% of the AMFI, or $47,300, would not have to pay more than $1,230 for a three-bedroom unit. These rent limits include utility costs.

According to the National Housing Preservation Database, Harris County had 54,498 federally subsidized housing units in 2024. About 73% of them are supported by the county’s HTC program, and approximately 9% — 3,716 units — are serving extremely low-income households (those who earn up to 30% AMFI).

At the neighborhood level (Community Tabulation Areas), six suburban neighborhoods (IAH, Spring Southwest, Alief, Willowbrook, Pasadena and South Belt/Ellington) and four urban neighborhoods (Northside/Northline, Five Corners, Acres Home and Sharpstown) have the most HTC-subsidized units.

Not guaranteed to stay affordable

In the next five years, approximately 4,352 HTC units in Harris County are at risk of being lost due to the expiration of their affordability periods. Over the next 30 years, 37,189 HTC units will face similar risks (see Figure 3). Preserving such units extends beyond those at risk encompassing publicly subsidized housing units and indicating that the overall discrepancy between the number of subsidized housing units at risk and the resources available for their preservation is even more pronounced.

The Texas HTC program sets aside 15% of the credit for federally subsidized multifamily housing — including HTC properties — at risk of ending their affordability terms. Among that, 5% is specifically designated as a priority for U.S. Department of Agriculture-assisted properties. In addition, at least 10% of the credit should be allocated to qualified nonprofit developers.

In 2024, about $95 million was allocated for 9% HTC projects in Texas. A rough estimate suggests that around $14 million of this funding could be used to preserve affordable housing units annually. Given construction costs of $21,996 in tax credits per unit, the HTC program in Texas could potentially save about 648 at-risk units per year.

Affordable housing is essential, but securing it remains extremely challenging for low-income renters. Harris County, where 45% of households were renters in 2021, urgently needs more affordable options.

In addition to bureaucratic hurdles to receiving tax credits, new affordable housing projects often face challenges posed by NIMBY sentiments. Additionally, existing LIHTC projects in Harris County are at risk of losing their affordability. Therefore, it is crucial to focus on both creating new affordable units and preserving existing ones.