“My other house wasn’t supposed to flood, and now insurance costs are going through the roof; it’s bad,” he told us. “I wanted to keep my grandma’s place in the family, but I don’t know how much longer I can stay. I’d love to, but it’s unsustainable.”

This 2023 Atlantic hurricane season, forecasters predict 12 to 17 storms will make the official alphabetized list of named events, with three to five of those becoming major hurricanes. If recent history is a guide, those that hit U.S. soil will trigger presidential declarations of disaster, bringing large sums of taxpayer money to affected communities.

Some of that money will go immediately to help people in need. Some will go to rebuild public infrastructure, like roads and levees. And some will go to buy and demolish flooded homes through a policy known as managed retreat.

Officials call it “retreat” because the aim is to pull property back from areas of growing risk, whether that risk comes from major hurricanes, rising seas, heavy inland rains or other climate hazards. It is managed in the sense that government officials use cost-benefit formulas to determine where it makes the most financial sense to spend taxpayer money to tear down at-risk homes.

What officials do not assess is where departing homeowners move, or if those moves actually reduce the homeowner’s future risks. That is not the government’s central concern – nor is the risk level at which different homeowners participate or how that might vary across the nation’s racially segregated housing markets. These are the other unknowns of hurricane season and, with them, America’s rising flood risk more generally.

We are a sociologist and a geographer at Rice University who study environmental hazards and recovery. In a new study, we investigated these unknowns and found both distance and race play outsized roles.

Tracking where people go in managed retreat

To visualize where people go after taking a home buyout, we built a nationwide database of nearly 10,000 U.S. homeowners who voluntarily sold their homes and moved through the Federal Emergency Management Agency’s Hazard Mitigation Grant Program between 1990 and 2017 and mapped their relocations.

That FEMA program is the largest managed retreat, or buyout, program in the country, by far. It pays homeowners a (pre-disaster) “fair market” price to acquire and demolish their flood-prone homes. To date, officials have implemented the program in more than 500 cities and towns in every state but Hawaii. Records for participating property owners were recently released through a petition filed under the Freedom of Information Act. NPR published that data.

After tracking down where homeowners moved, we attached flood risk scores to their origin and destination addresses. These flood factors come from the First Street Foundation, a nonprofit source of flood risk ratings that are now integrated into online realtor websites such as Redfin. We also attached local census data.

Most homeowners who retreat stay close

Regardless of location, we found that most retreating homeowners do not move far.

Nationwide, the median driving distance between people’s old and new homes in our database is just 7.4 miles (11.9 kilometers). Nearly three-quarters, 74%, stayed within a 20-mile (32-kilometer) drive. Jobs, friends and family can all play a role.

Notably, these short-distance moves go missing in most publicly available databases of residential mobility, such as Census migration files. When illuminated, they reveal that most retreating homeowners are not moving long distances to safer towns, states and regions; they are churning in and between nearby neighborhoods.

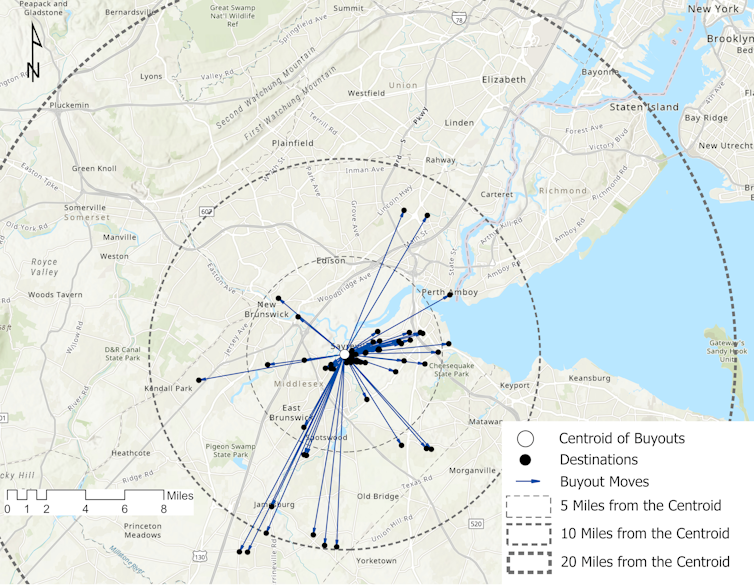

A good example is the 84 homeowners who retreated with the help of FEMA’s buyout program from a single neighborhood in Middlesex, New Jersey, following Superstorm Sandy in 2012. The vast majority moved within a 5-mile (8-kilometer) drive, and many moved toward the shoreline, not away from it.

These local moves are good news for local tax bases because ongoing demand for local housing maintains its value and may even stimulate new development.

They are also good news for local flood control efforts. Nationwide, 70% of participants lowered their flood risk score through retreat, while only 8% increased it. The average decrease was 63%, from 5.6 on First Street’s flood factor to 2.1 at destination.

These findings show that sustained community attachment and risk reduction can go together.

Race plays a role

Across the U.S., our analysis also shows that the best predictor of retreating homeowners’ risk tolerance before selling is not whether they live in a coastal or inland area, or whether they live in a big city or a small town. It is the racial composition of their immediate neighborhood.

We found that retreating homeowners in majority-white neighborhoods are willing to endure 30% higher flood risk before selling to the government and relocating than homeowners in majority-Black neighborhoods.

Prior research suggests several reasons why this might be so. One is the heightened social status of predominantly white neighborhoods, which can encourage significant public and private investment after major disasters. These investments make it physically as well as financially safer to stay in properties at higher risk or to sell through the market rather than engage in government-funded retreat.

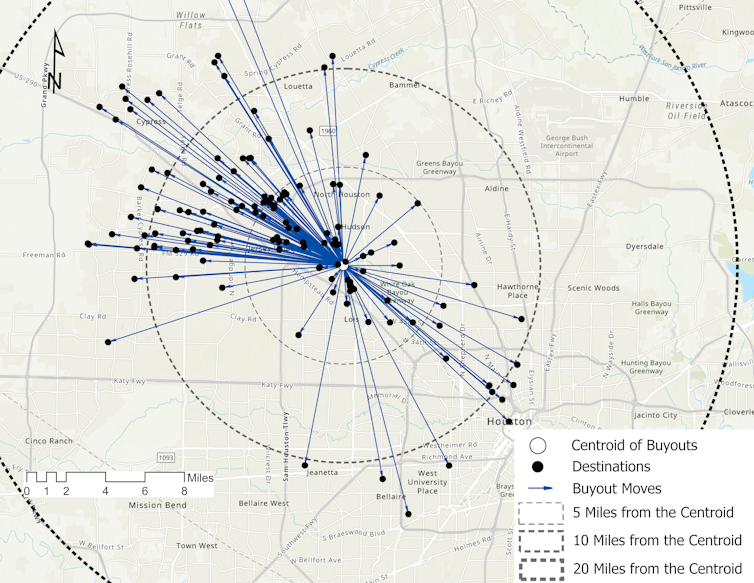

Another likely reason involves who is actually retreating from flood-prone communities of color. In Houston, for example, one of the strongest predictors of retreat is not the current racial and ethnic composition of one’s neighborhood but the extent to which white residents have left in recent decades, sometimes referred to as “white flight.” Meanwhile, homeowners of color in historically nonwhite communities often resist retreating for reasons that can include a general distrust in government, deep attachments to place and lack of affordable housing nearby.

Lessons for future buyout programs

Our results offer an important lesson to policymakers: Unless homeowners can stay close, find communities similar to those they’re leaving or once lived in and reduce their household flood risk, most will not relocate voluntarily. Retreat, it seems, is shaped not just by rising environmental threats, increasing insurance premiums and government cost-benefit assessments, but also by community ties that racially segment who retreats where and at what risk thresholds.

The week of June 19, 2023, hundreds of scholars, planners and community organizers will be discussing these and related complexities of managed retreat at a national conference in New York. Like Kirt Talamo, their minds will be on what happens next in a world where past housing decisions seem to be increasingly unsustainable.

James R. Elliott is a professor of sociology at Rice University and Zheye (Jay) Wang is a senior spatial research analyst for the Kinder Institute for Urban Research.

Note: This article is republished from The Conversation under a Creative Commons license. Read the original article.

![]()