Cities across the country are gradually seeing their finances return to a state of a normalcy, but years after the recession ended, local governments still face economic challenges, according to a new study published this month by the National League of Cities.

The findings are based on the results of a survey of finance officers in cities across the country that the organization has administered since 1986.

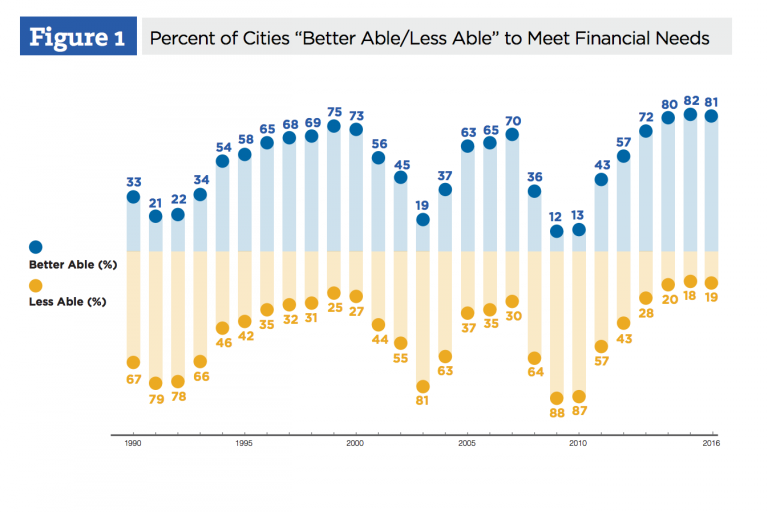

Today, 81 percent of city finance officers said their communities are in a better fiscal position this year than last, according to the survey. That's comparable to last year's results and among the most positive appraisals since 1990, suggesting that the fiscal stress the recession brought onto cities has finally leveled off.

The good new, for cities, is that property tax revenue growth is continuing its return to pre-recession levels. Property tax revenues grew 3.77 percent in 2015 and 2.6 percent in 2016. That's not quite as high as it was before the housing bubble burst -- it eclipsed 6 percent in 2007 -- but it's vastly better than the negative growth experienced in the early 2010s.

The positive news is reflected in cities' general fund ending balances -- or, essentially, their rainy day funds. Those funds can carry cities through emergencies, and they are viewed by bond underwriters and others as a measure of fiscal health. Ending balances hit 24.5 percent of general fund expenditures in 2015, continuing their positive trend.

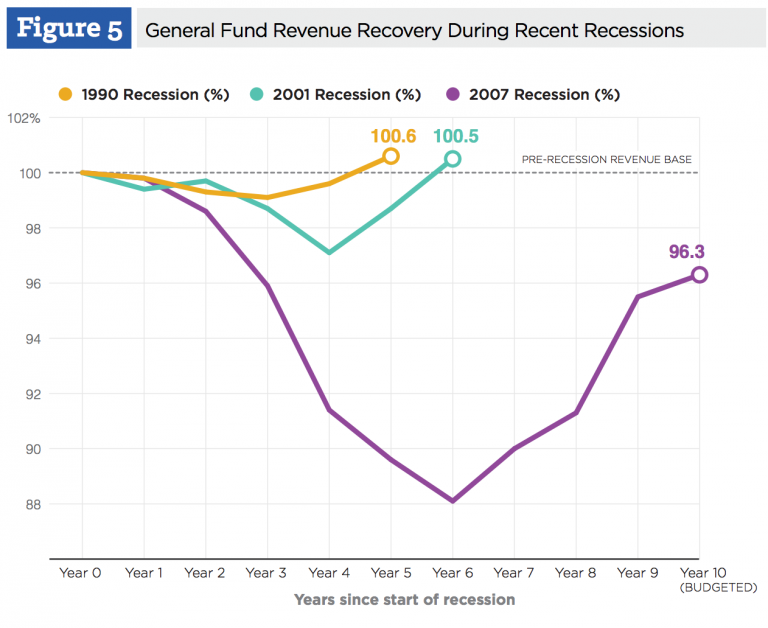

All in all, cities -- by and large -- are back to where they were financially before the recession. After a six-year slog, their revenue is just about back to where it was before the bottom fell out of the economy.

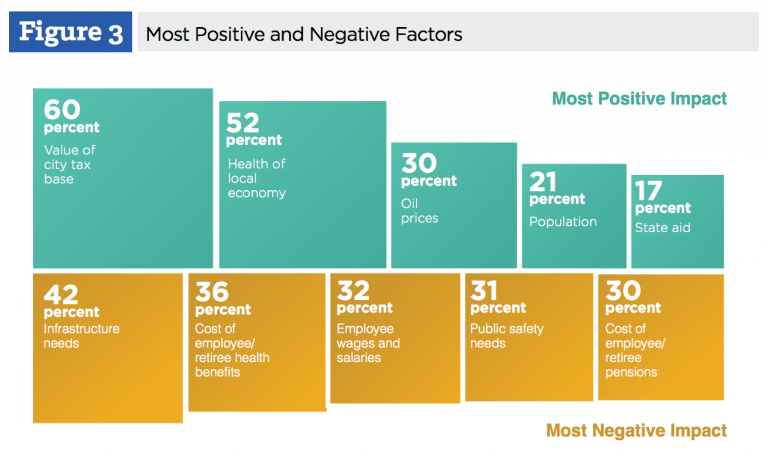

Still, hurdles remain: city leaders say factors like infrastructure needs, retiree health benefits and employee wages are negatively impacting their finances, along with pension costs and public safety expenses.

"These issues are not new to cities," NLC wrote, "but the confluence of a slow recovery and growing need are exacerbating the impact of these challenges on local budgets."

To shore up their funding, cities are also taking several common steps to boost revenue. More than 40 percent of them said they've increased various fees. More than 20 percent have increased their property tax rate in 2016, which is comparable to previous years.

NLC warns that cities continue to face threats to their economic stability including:

- depleting stocks of affordable housing, which may force workers to move further from job centers

- slow and inequitable employment and wage growth, which could impact city revenues

- healthcare costs and pension liabilities that will continue to draw on scarce revenue, forcing competition with other city services over revenue

Though city revenues are now "showing signs of vitality," NLC writes, city revenues still haven't fully recovered from the Great Recession -- and if another recession emerges in the coming years, many communities may enter it with already-suppressed revenue.