Image via flickr/Leandro Neumann Ciuffo.

With homeownership at a 50-year low, researchers have highlighted how rising home prices and other economic factors are keeping one particular category of consumer -- repeat homebuyers -- out of the housing market and possibly stuck in their starter homes.

Home affordability remains a concern for many consumers -- in particular for young people strapped with student loan debt. But it hasn't been an insurmountable hurdle for them. First-time homebuyers appear to be buying just as many homes as they did pre-recession.

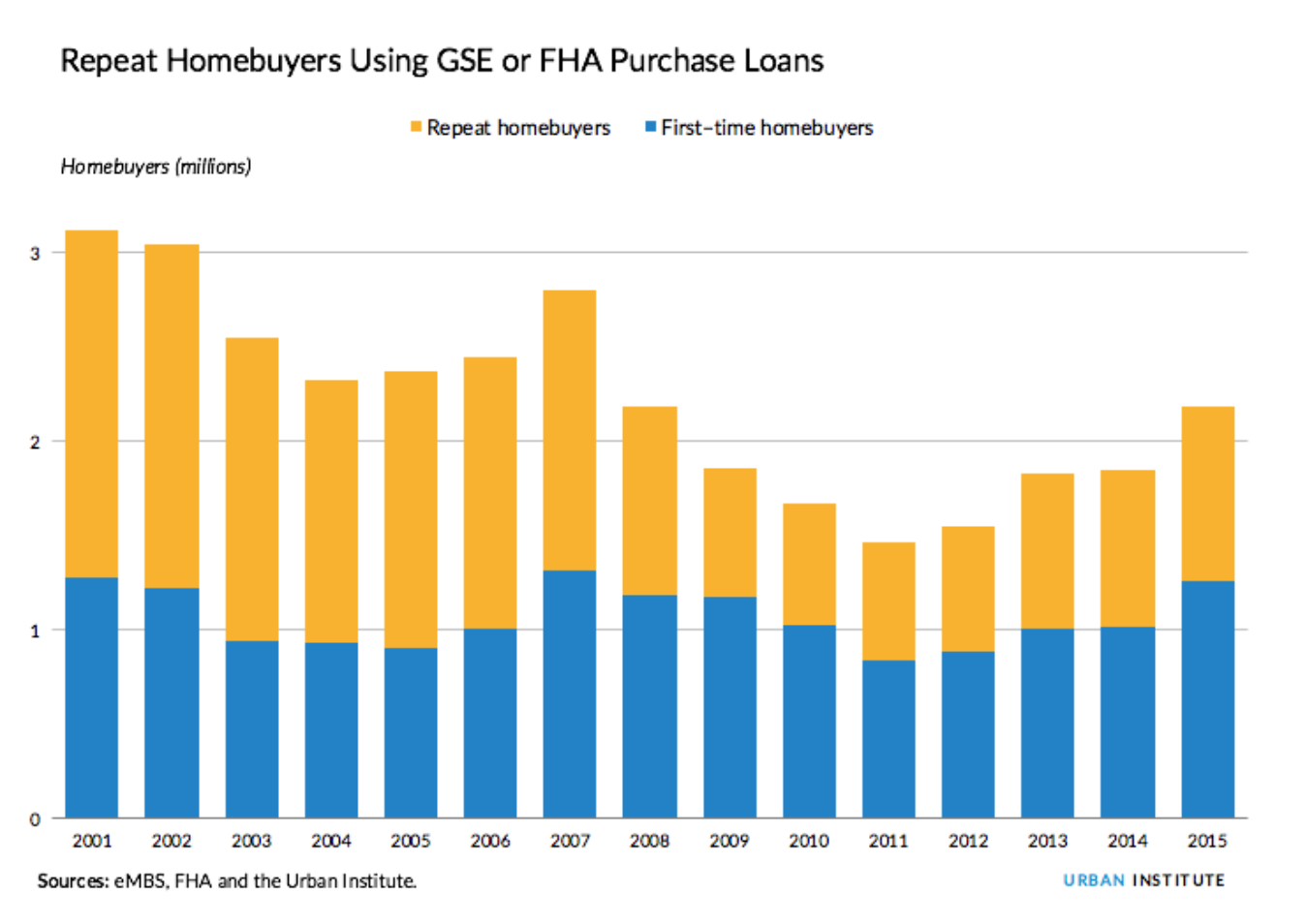

But another category of consumer -- repeat homebuyers -- still lags behind pre-recession levels, according to a new Urban Institute study.

In 2001, there were 1.8 million repeat homebuyers. After the housing collapse, those numbers dipped to 700,00 in 2009, creeping up to roughly 900,000 in 2015, according to an analysis written by Laurie Goodman, Sheryl Pardo and Bing Bai. Even with that growth, the researchers write, "this is still half the number from 2001."

So what, exactly, is going on?

Across the board, the number of loans by government-sponsored enterprise and the Federal Housing Administration are down, overall, from 2001.

In absolute numbers, the amount of first-time homebuyers is actually the same as it was in 2001, notes Pardo, the think tank's associate director of communications. Of course, she said, "it should be a lot more since the population is bigger."

But as a share of mortgages, first-time homebuyers are going strong, representing 57 percent of the market as of June 2016. "They have consistently represented at least 53 percent of the market since 2008 compared with less than 48 percent between 2001 and 2007," according to the analysis.

That's a relatively new trend: before the recession, it was repeat buyers who dominated the market.

The trend may be concerning. A decreased number and share of repeat homebuyers could mean that families are stuck in what otherwise would be starter homes.

"When you think back on how it used to be, home prices were going up, you used the accumulated equity in your first home to buy your second home," explained Goodman, co-director of the Institute's Housing Finance Policy Center. "Obviously, the financial crisis wiped out a lot of that accumulated equity."

Though the latest census numbers show strong median income growth nationally recently, and some markets have seen home prices steadily rise, that's not happening everywhere. For many, incomes are flat, and their homes aren't increasing in value, possibly leaving them trapped in starter homes even as their families may be growing.

"Home values nationwide must still increase by 6.5 percent to reach peak values," the report said. "Real incomes have been flat since the mid-1990s, and credit standards are tight, further limiting trade-up activity."

But this trend isn't necessarily a bad thing, notes Joe Cortright over at City Observatory. he sees it from a different perspective. "For the most part, the dominance of trade-up buying was a symptom of last decade’s tragic and un-sustainable housing bubble," he wrote on his blog.

Maybe sticking in starter homes is the financially responsible thing to do.

"We’re not opining that it’s a good or a bad thing," said Pardo, noting that the Urban Institute received feedback from homeowners saying things like, "What's wrong with staying in a simple, smaller home?"

One caveat Goodman adds is that with less turnover and supply on the market, there could be a factor working for homeowners: Those limited options for potential buyers could drive up prices.