There's no shortage of data points that experts look to as they try to examine exactly what's happening to the U.S. economy.

But one that's worth paying especially close attention to is a survey of U.S. mayors conducted every two years.

While the study is light on hard numbers, it does cut through the noise to answer a fundamental question: how are American cities doing in the eyes of those who know them better than anyone?

Turns out the answer is a nuanced one which, unfortunately, probably isn't a surprise. For some, the country's economic recovery is chugging along smoothly, with a bevy of good news about business startups and property values.

But for others, the economy remains an ongoing challenge. Six years after the country's recession officially ended, many parts of society continue to struggle.

The National League of Cities, which conducted the mayors' survey, calls it the country's "unequal recovery."

"This year’s survey demonstrates that there are two different storylines playing out in cities: economic conditions are improving for some, but worsening for others," the National League of Cities wrote in its report, published earlier this month. "This is troubling both socially and economically, making an even stronger case for inclusive growth policies that move the needle towards equity in our nation’s cities."

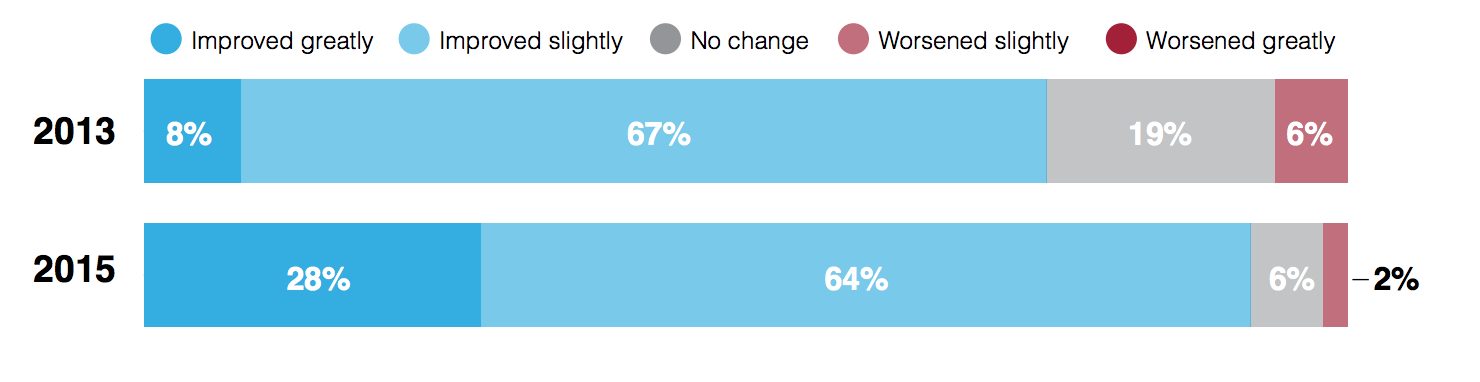

To be clear, overall, the poll of 251 mayors reveals that they are generally reporting good economic news. The aggregate numbers below indicate that 92 percent of mayors this year said their local economies have improved. Moreover, it's clear that there's much more optimism about the economy than there was two years ago, the last time the mayors were surveyed on the topic.

But the dichotomy of the report plays out in several different ways. For example, compare how different sized cities are recovering.

Cities with a population of 100,000 to 300,000 were twice as likely as those with populations below 50,000 to indicate their economies had greatly improved. More generally, the smallest cities were most likely to report worsening economic conditions and the least likely to report improvements.

If that seems like a normal situation -- perhaps for some reason, smaller cities generally recover more slowly -- it shouldn't. Faster growth in large metros relative to small ones is something that's unique to this recovery, according to Moody's data cited by NLC suggesting the effect is caused by a housing rebound resulting from more people moving to big cities.

But the most striking disconnect comes when NLC asks mayors to give deeper insights into specific facets of their recovery.