Along with following these broader shifts, the 2022 State of Housing in Harris County and Houston report also features new insights into the racial outcomes in the mortgage market and homeownership rates, as well as assessments of disaster risk and climate resilience indicators throughout the county.

Despite not having access to the full range of data that we typically use to document the region’s housing—the Census’ American Community Survey, which was affected by the pandemic—our 2022 report paints a robust picture of where we stand as a region.

A widening affordability gap

As the report offers in full detail, surging demand for single-family homes and plummeting supplies led to historic price increases in Houston and Harris County—a well-known fact for anyone who tried to buy a home here in the past year.

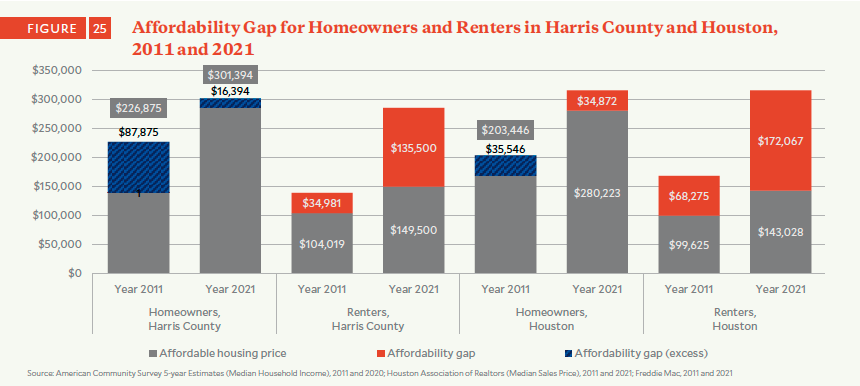

This has also resulted in a far worse situation for people earning the median household income or less, especially renters. The affordability gap is an important measure of to what extent homeownership is within reach—it is the difference between the median sales price and what the median household income can afford, assuming 30% of income is dedicated to housing costs.

Over the past 10 years, the gap for the county’s renters grew by $100,000 and by $38,000 from 2020 to 2021 alone. In 2021, the countywide median sales price of a home ($285,000) was about twice the price of a home that the county’s median renter can purchase ($149,500). A decade ago, households in Harris County earning the median household income could afford a median-priced home with money to spare; in 2021, that same family would fall short by almost $70,000.

Sales prices in the county’s suburban neighborhoods have also been reaching new highs, and for the past few years, the county’s median home price has been increasing faster than the city of Houston’s. The price gap between the city and county could soon disappear, and homeownership rates are likely to continue sliding if prices remain out of reach.

Our report did not track apartment rents unless they were included in the Houston Association of Realtors’ dataset, but we also note that rental home prices are rising. The region is also seeing more overcrowding, which is a likely outcome of having an insufficient number of affordable rental units on the market. The county simply has far too few units available for people earning below median household incomes. Based on estimates we prepared for the My Home is Here study, Harris County needs to build almost 150,000 more units that are affordable to the lowest-earning households.

An increasingly vulnerable system

Rising prices are not the only threat to the region’s affordable housing supplies. We know from past research the effects of Hurricane Harvey, COVID-19 and Winter Storm Uri have been concentrated among several Houston-area communities, particularly those with lower household incomes. We also know that the county’s overreliance on so-called “naturally occurring affordable housing,” which does not receive public assistance, means that hundreds of thousands of units are vulnerable to rent increases and lack of upkeep.

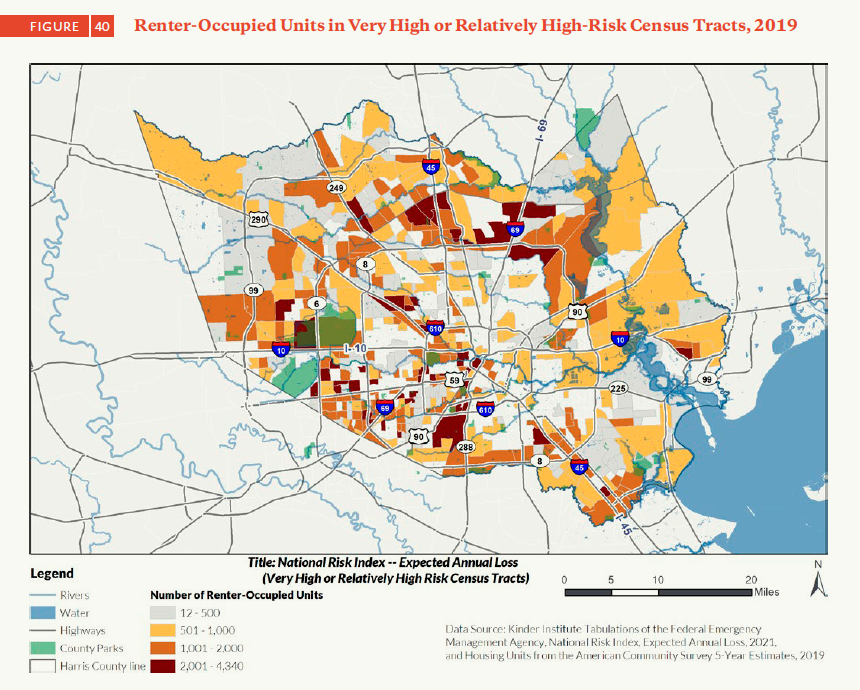

Meanwhile, new analysis of FEMA data in the State of Housing report reveals that almost half a million rental units, including a significant share of those affordable units, face a high number of disaster risks. While FEMA’s assessment of risk shows there are pockets of high risk throughout the county, our own analysis shows that the east side of the county has some of the lowest housing resilience—that is, having more aged properties with lower quality and lower values. These areas are vulnerable to displacement—not only by a natural disaster but also by gentrification.

The county also remains vulnerable to an eviction crisis. We know from US Census Household Pulse Surveys that, on average, an astounding 1 in 5 Houston area residents expressed fears about making a rent payment throughout 2020 and 2021. Over the past two years, millions of dollars in federal rental assistance has helped 70,000 households in the Houston area stay in their homes. Meanwhile, local efforts to reduce homelessness have gained further acclaim. These bright spots demonstrate that good policy can build better communities, protect livelihoods and reduce the impact of disasters.

But with most rental assistance funds used up and evictions returning to—and in some cases exceeding—prepandemic levels, housing advocates may find 2022 and 2023 to be very challenging years for residents who live paycheck to paycheck. In the past six months alone, Harris County has recorded 36,000 eviction filings. Rising rents and a lack of attainable housing alternatives in the county will push these residents out into farther-flung communities, into increasingly crowded units or into temporary homelessness.

It is our hope that the State of Housing report helps policymakers and nonprofit agencies direct resources where they are needed most.