It’s not surprising that Americans, on the whole, are deep in debt. That hole got deeper this year as U.S. consumer debt grew to almost $14 trillion. That includes money owed on mortgages, auto loans, student loans and credit cards.

Consumer spending accounts for 66% of the nation’s gross domestic product, and the cycle of extending credit, creating debt and repaying that debt plays a big part in how the economy functions.

Very few people can buy a house or a car or afford a college education for themselves or their kids without borrowing money. Having this kind of debt isn’t a bad thing if managed well. Mortgages make up the bulk ($9.4 trillion) of Americans’ debt. However, experts consider that increase as positive — an indicator of the housing market’s continued recovery. A person’s ability to get a loan, and at what interest rate, and their access to credit can be determined by debt.

Then there’s credit card debt. Unlike loans for homes, cars and education, credit cards are revolving debt with no set interest rates, payment amounts or repayment periods. They aren’t used to purchase assets that appreciate in value, like a house or real estate. They’re short-term debt meant to be paid off in less than a year. Ideally, they’re paid off each month, though that’s not always possible. The problem is, of course, either by choice or out of necessity, many people don’t use credit cards this way.

Five Houston-area cities were ranked among those with the least sustainable credit card debt in the nation. Source: Wayne S. Grazio / Flickr

The cities with the least sustainable credit card debt

According to the U.S. Consumer Debt Crisis, more than 189 million Americans have credit cards, and the average credit card holder has at least four cards. Each household with a credit card carries an average of $8,398 in credit card debt. One-third of that debt is caused by medical bills.

A WalletHub analysis of data from the credit reporting agency TransUnion showed five suburban Houston cities among those with the least sustainable credit card debt in the nation.

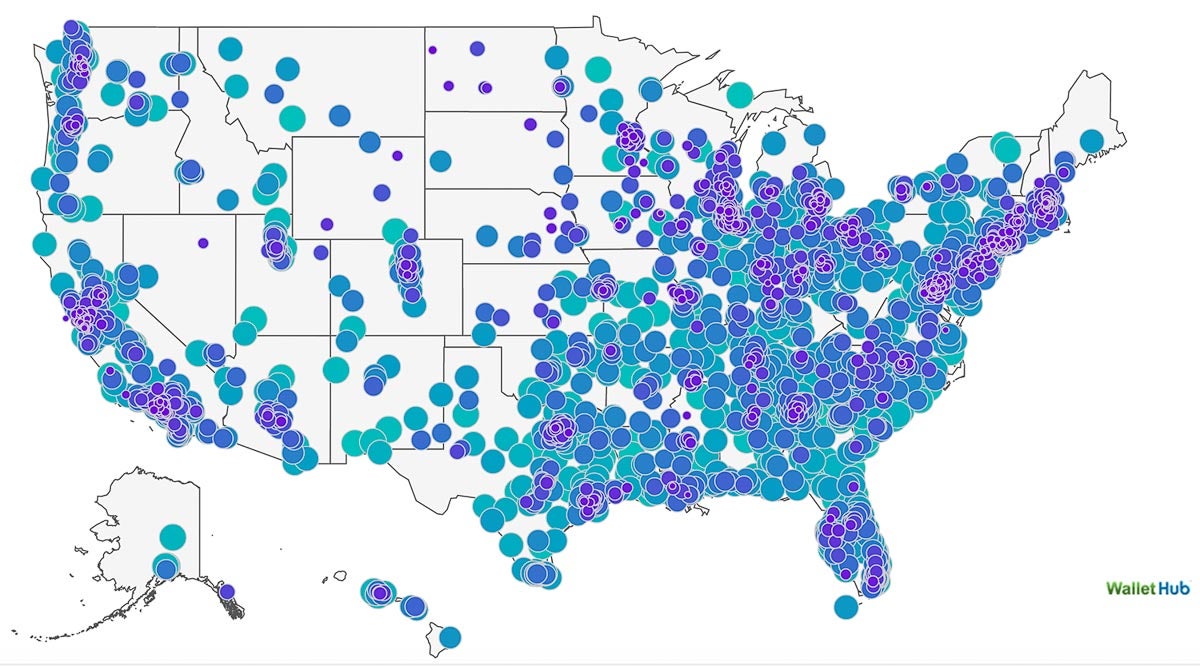

The findings were based on the median credit card balances of residents in more than 2,500 cities. The cities were ranked from least to most sustainable by the amount of time it would take residents to pay off their credit card debt.

WalletHub analyzed TransUnion credit data to calculate the cost and time required to pay off the median card balances of more than 2,500 U.S. cities. View the the dynamic map here.

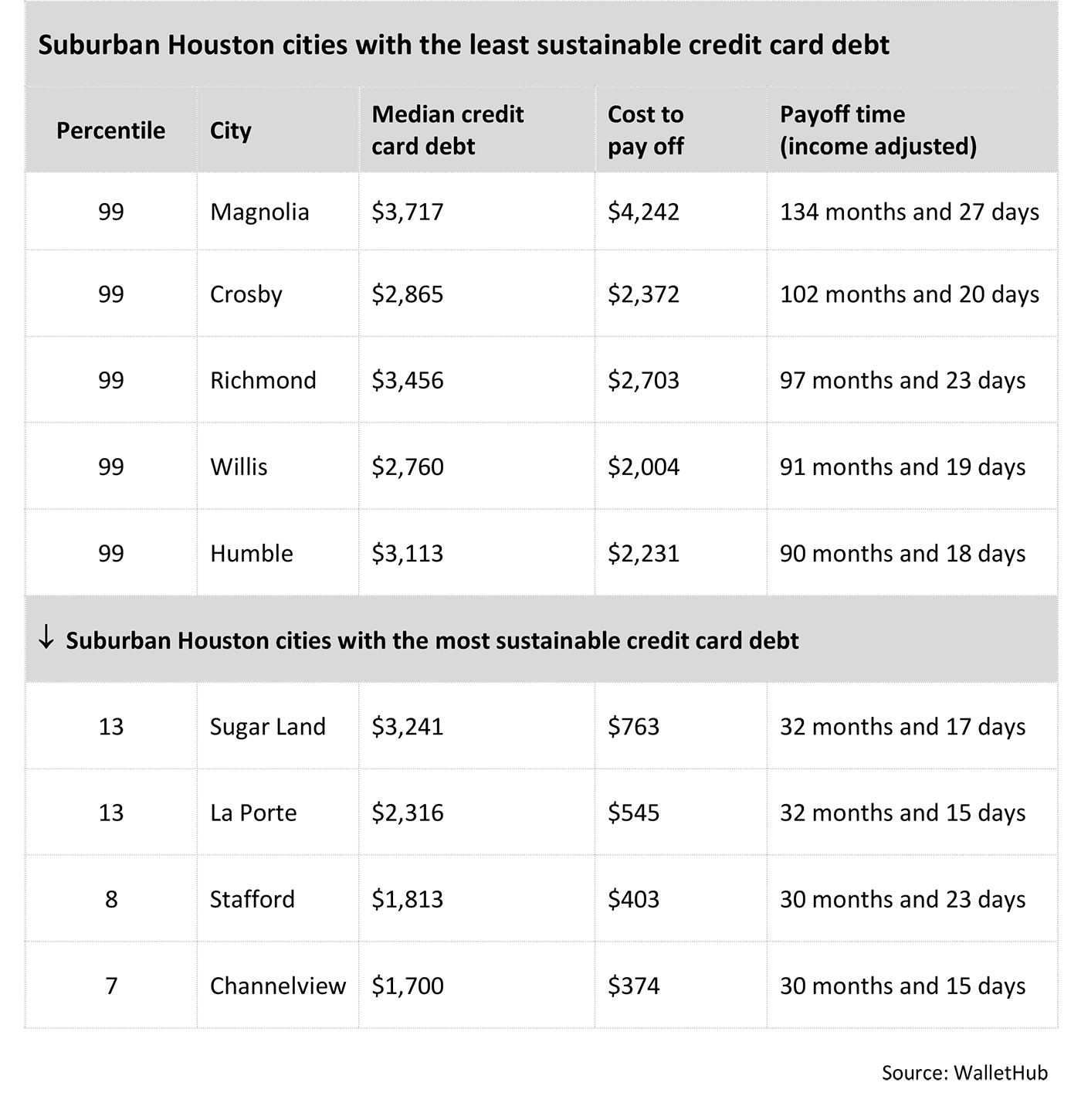

Magnolia was number two on the list with a median debt of $3,717, a cost to pay off of $4,242, and a payoff time of 134 months and 27 days. Other Houston-area cities among the 30 in the 99th percentile, and therefore considered one of those with the least sustainable credit card debt, were Crosby (14), Richmond (16), Willis (19) and Humble (21).

Houston was in the 80th percentile. Residents here had a median debt of $2,633, a cost to pay off of $1,046, and a payoff time of 53 months and nine days.

Cities in the area with the most sustainable credit card debt were Channelview in the 7th percentile ($1,700 median debt /$374 cost of pay off /30 months and 15 days payoff time), Stafford in the 8th percentile, and La Porte and Sugar Land, both in the 13th percentile.

Should we be alarmed by the rise in debt and delinquency?

According to WalletHub, yes. “Nationwide, consumers added $21.5 billion in credit card debt during the third quarter of 2019, pushing total balances to record levels for this time of year. Clearly, this is a ticking time bomb for the country’s economy overall.”

Credit card debt started the year at $1 trillion but has grown to $1.08 trillion. It’s the highest it’s been since the start of the Great Recession. Consumers’ attempts to pay off their maxed-out credit cards were a contributing factor to the financial crisis.

People cut back on using credit cards following the 2008 financial crisis and credit card debt fell by 22.5% between 2008 and 2011. It’s remained steady since then.

But a report released last week by TransUnion shows the number of people who are delinquent on their credit card payments is projected to hit a 10-year high in 2020. Both American household debt and credit card delinquency rates have been climbing over the past five years, but not sharply enough to concern most experts.

“What we know is we are at a level of credit card debt we have not seen since before the great recession of 2008,” Dean Smith, who teaches finance at East Carolina University, told WalletHub. “One of the factors that contributed to the financial crisis is after people maxed out their credit cards, they used the equity in their home to pay them off. When the price of homes fell, they had no equity, or even negative equity, in their homes. People began to default on their loans when they could not keep up with the payments, or they lost their jobs.”

Last month, a report from the Urban Institute showed 62% of Houston's households are financially insecure. It also revealed the city's residents have credit scores below the national average and the rate of delinquent debt here is higher than the national average.

___________________________________________________________________________

According to the experts …

A panel of credit experts were asked by WalletHub to weigh in on issues such as mistakes people make in managing credit card debt, behaviors that lead to growing debt and how the growing debt affects the economy.

What daily behaviors lead people to amass credit card debt?

Impulse buying combined with the ease of obtaining credit and the convenience of online buying is driving the behavioral issue. Before the internet, obtaining a credit card had more barriers that worked against “easy credit”. For example, you had the inconvenience of filling out a paper application and mailing it to the card issuer. It wasn’t simply a matter of saying yes to a prescreened email application. Further, the advent of Amazon’s pioneering “one click” technology to make a quick purchase with a preset credit card was rapidly adopted by other platforms with similar “convenience” built-in.

— Kevin S. Walker, associate professor of Business, Eastern Oregon University

They don’t have a savings account. When an unanticipated irregular expense occurs, they have no choice but to put it on a credit card. An example of this is medical expenses. ... While some people argue saving accounts earn low-interest rates – which is true – the purpose isn’t to make money. It is avoiding paying double-digit interest on a credit card.

— Dean Smith, director of Student Centers for Student Involvement and Leadership and a Finance instructor at East Carolina University

Not treating credit cards as cash, which is gone once spent, is the biggest mistake people make. Big debtors have the tendency to look at credit card limits as “other people's money” and that works till the bill becomes due! That and the need for instant gratification inherent to our society.

— Abir Mandal, Assistant Professor of Economics, University of Mount Olive

What is the biggest mistake people make when managing credit card debt?

Kevin S. Walker: Time value of money. They simply see a minimum low payment and ignore how much of that payment is interest. The consumer infers, wrongly, the logic of “the less I pay, the more money I have to use this month.” Immediate gratification becomes their worst enemy. They don't see that zeroing out the debt causing $1000 per month in credit card payments is equivalent to receiving a $12,000 raise in discretionary income.

Dean Smith: They make minimum payments.

Abir Mandal: Paying only the minimum amount.

How does the growth of credit-card debt affect the economy?

Keven S. Walker: In my opinion, initially, consumer spending based upon on credit card usage boosts the economy. However, eventually, a rise in credit card debt tends to lead to a drop in economic output simply because more discretionary income is repurposed to service mounting credit card debt. The cards are maxed, and more consumer income is used to service credit card debt, therefore, there is less money available consumer spending on goods.