Houston Mayor Sylvester Turner, originally sought a temporary nine percent property tax hike to finance the city's recovery after Harvey. His back and forth with Texas Governor Greg Abbott urging the state to tap into its emergency Rainy Day Fund garnered headlines. Instead of leveraging that fund, though, Abbott delivered $50 million of the state’s $100 million disaster relief fund to the city. In response, Turner took the temporary tax hike off the table but $50 million won't cover the city's expenses.

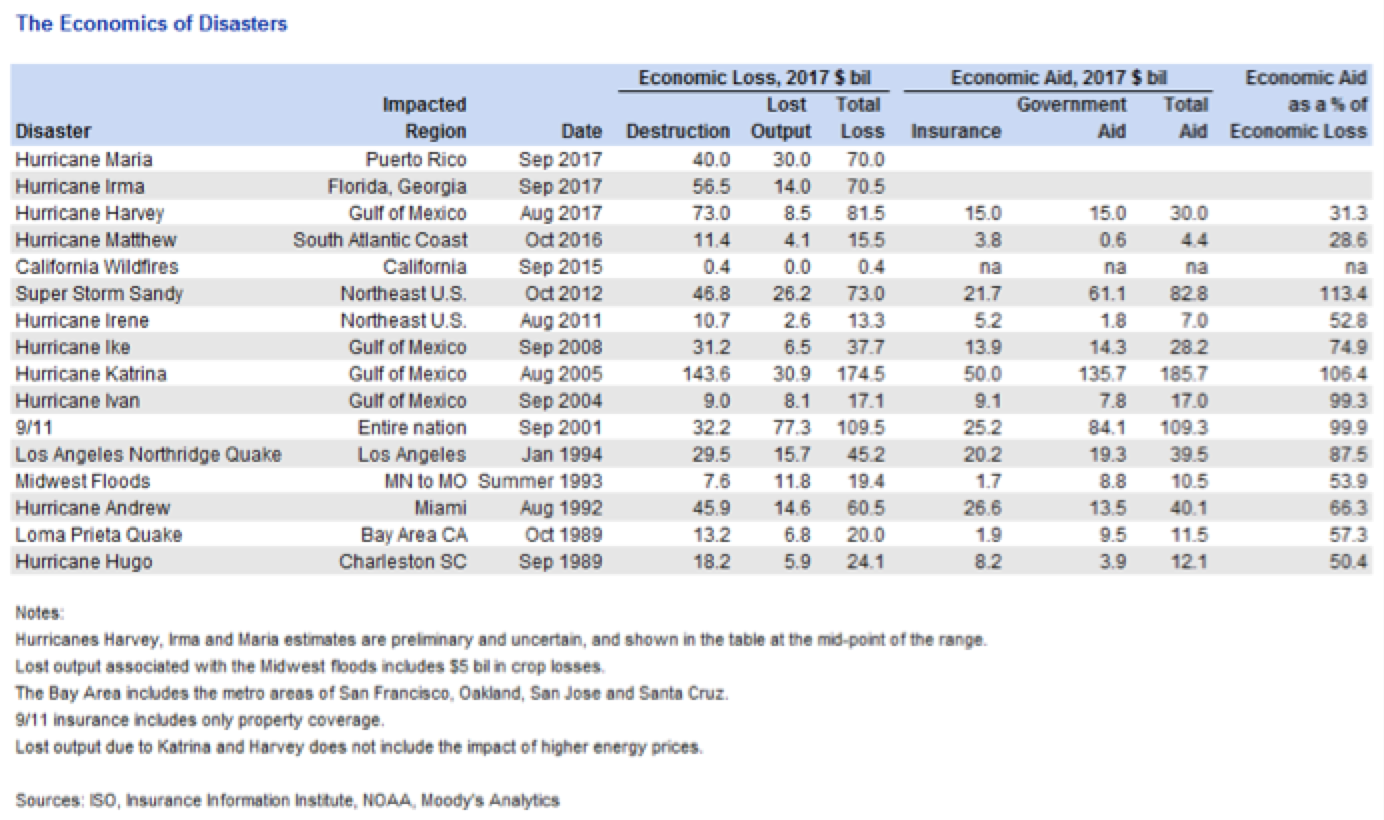

The most recent report, from Moody’s Analytics, puts the total loss of the storm at an estimated $81.5 billion, down from the original projection of up to $108 billion, right after the storm.

Now, as part of the effort to cover those costs, the city has asked volunteers to report their hours in Harvey relief efforts to optimize Public Assistance funds from the federal government. Even if volunteers worked out of sheer altruism, registering their hours can ensure the full cost of the recovery is covered.

That $81.5 billion number includes $73 billion in property damage to residential real estate, commercial real estate, retail, office, and apartment damage. Additionally, the total cost includes $8.5 billion in lost output. Despite the large losses in damages, Harvey was not as destructive to economic output as is usually expected from similar disasters, according to the original Moody’s Analytics report.

Although the economic cost of Harvey is not as great as was originally feared it still represents a considerable burden to state and local leaders as recovery continues. The extensive and unexpected expenses from major natural disasters are primarily financed by the federal government through the Federal Emergency Management Admiration (FEMA) through provisions of the Stafford Act.

The financing discussion can leave many people on edge, with local leaders trying to ensure the full cost of the damage is covered and higher jurisdictions seek to maintain fiscal solvency amid the increasing number of disaster situations.

Through the many paths for federal financial assistance after a disaster, a significant portion comes from the Public Assistance component of the FEMA federal aid. According to the FEMA Public Assistance Program and Policy Guide, emergency work funded through this program is categorized as debris removal and emergency protective measures. To be funded this work has to principally be tied to the disaster region and adequately documented. FEMA determines the payment by evaluating several factors, primarily the cost reasonableness, market price for the service, and other factors such as worker shortages during the disaster.

“In times like these, it’s important to have fiscal responsibility as opposed to financial panic,” Abbott said during a recent news conference, pushing back against Houston's requests. While the statement is appropriate enough, the fiscal instability of the FEMA and the National Flood Insurance Program (NFIP) should oblige state and local leaders to consider alternative funding mechanisms throughout the recovery.

The increasing number of federal disasters in recent years as well as the outmoded flood risk maps are at least partially responsible for the fiscal insecurity faced by FEMA and the NFIP. This year alone there have been 49 major disaster declarations from FEMA and 15 emergency declarations. The extensive number of disasters makes the need for reform of the nation’s disaster financing system all the more urgent. It is time for local, state, and federal leaders to adopt innovative changes and reevaluate disaster mitigation programs.

Carlos Villegas is a staff researcher with the Kinder Institute’s Urban and Metropolitan Governance program.