The cities with blue dots are considered economically strong cities with threats to financial stability. Source: Urban Institute.

The cities with blue dots are considered economically strong cities with threats to financial stability. Source: Urban Institute.

Mayor Sylvester Turner warned that failing to support his pension reform plan would put the city in financial jeopardy as it sought to bridge an unfunded liability gap of at least $3.9 billion. But after voters approved a $1 billion bond package this November, his fears can be put to rest. In response to the vote, Moody's upped the city's credit outlook from negative to stable, though the overall rating remained the same.

But how financially healthy is the city overall? That's a bigger question, according to a new tool and analysis from the Urban Institute which also takes into account the financial health of the city's residents.

"Financially healthy residents are better able to weather difficult times, are less likely to need city supports and services, and can contribute more to the local economy by supporting property, sales, and income taxes," the report notes.

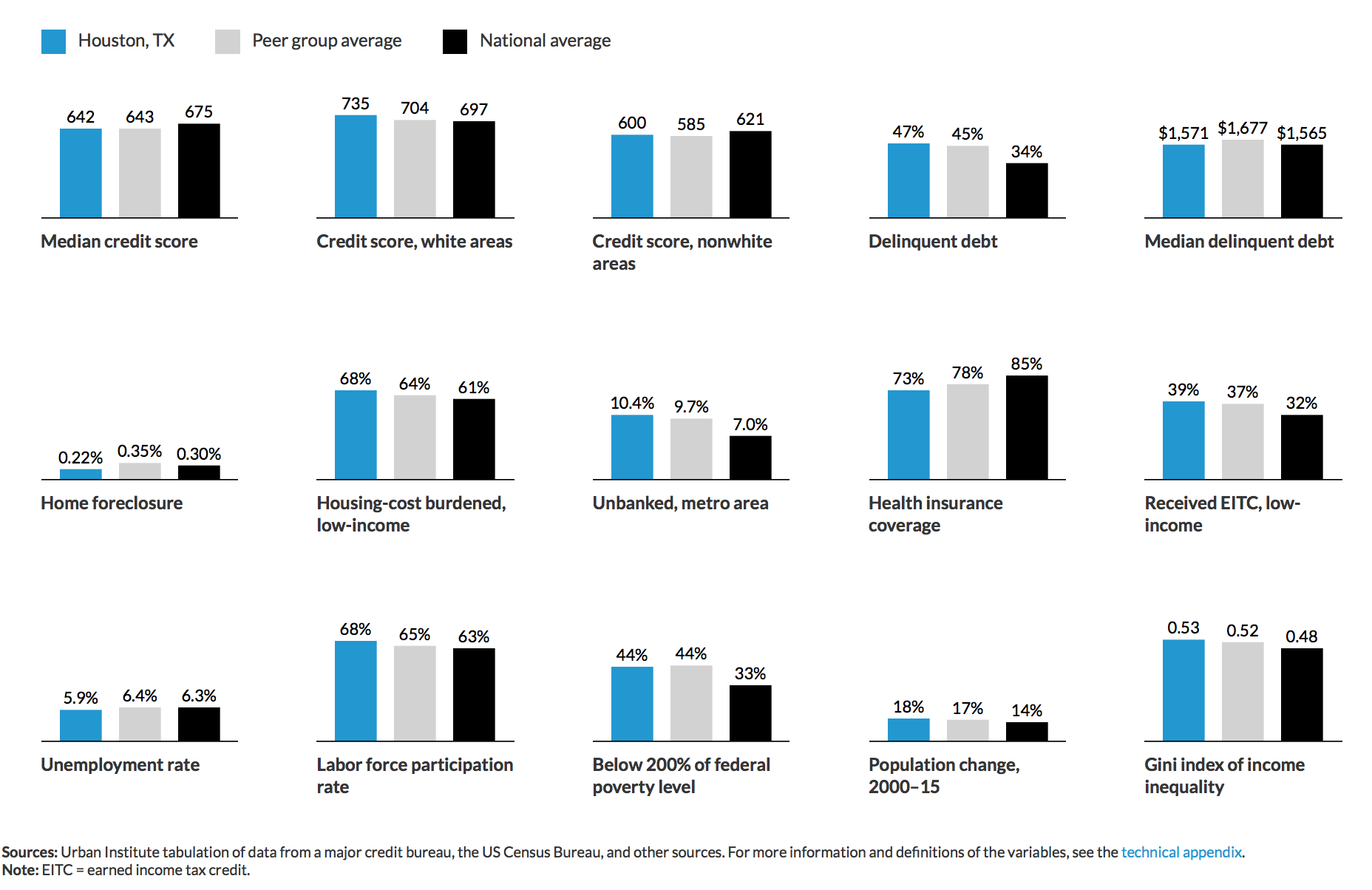

The report broke cities into nine categories, including cities in recovery, economically stable cities with lower housing costs, rapidly growing cities with threats to financial stability and other categories by looking at variables like debt, foreclosure, credit scores, health insurance and other measures of financial stability.

Houston, along with Dallas, San Antonio, Phoenix and several other peer cities all located in the Sun Belt, was classified as an economically strong city with threats to financial stability.

Compared to the national average, Houston had higher than average housing-cost burdens for low-income residents, a larger share of its population without health insurance, greater income inequality, more people living below twice the federal poverty level and fewer people with a bank account, as well as more people with delinquent debt.

Still, home foreclosure was lower than the national average and the labor force participation rate was higher. Several factors help explain the identified threats to financial stability including the fact that Texas was one of several states that did not expand Medicaid.

In Houston, the question of financial health has also taken on a post-Harvey lens, with many hard-hit neighborhoods also among the most socioeconomically disadvantaged.

"If you think about Fifth Ward and other underserved areas, [we] are challenged because we have not recovered from Hurricane Ike, so now you have additional damages sustained that have not been repaired," Kathy Flanagan Payton, president of the Fifth Ward Community Redevelopment Corporation, told the Urban Edge. "I can go back to Allison and Rita and Katrina. Each time these storms take a little bit out."

The report from the Urban Institute also offers suggestions for cities to build up financial health among residents, including expanding health insurance, creating programs that encourage workers to save money, providing financial counseling and engaging in outreach and education efforts.