America's wealthiest spend a lower percentage of their incomes on their housing than they did a decade ago, despite their incomes rising, while poorer Americans are having to spend a higher percentage of their income on housing, according to an Apartment List analysis.

And this is happening across America.

The analysis notes each of the top hundred U.S. metros, including Houston, have "housing costs growing more quickly for those in the bottom half of the income distribution than for those in the top half." Further, the disparity continues not only between the rich and the poor but for renters and homeowners, too.

"Today renters at all income levels are spending a greater share of their income on rent than they did in 1980," the report said. "Homeowners are paying a smaller fraction of their monthly paychecks for housing than they used to."

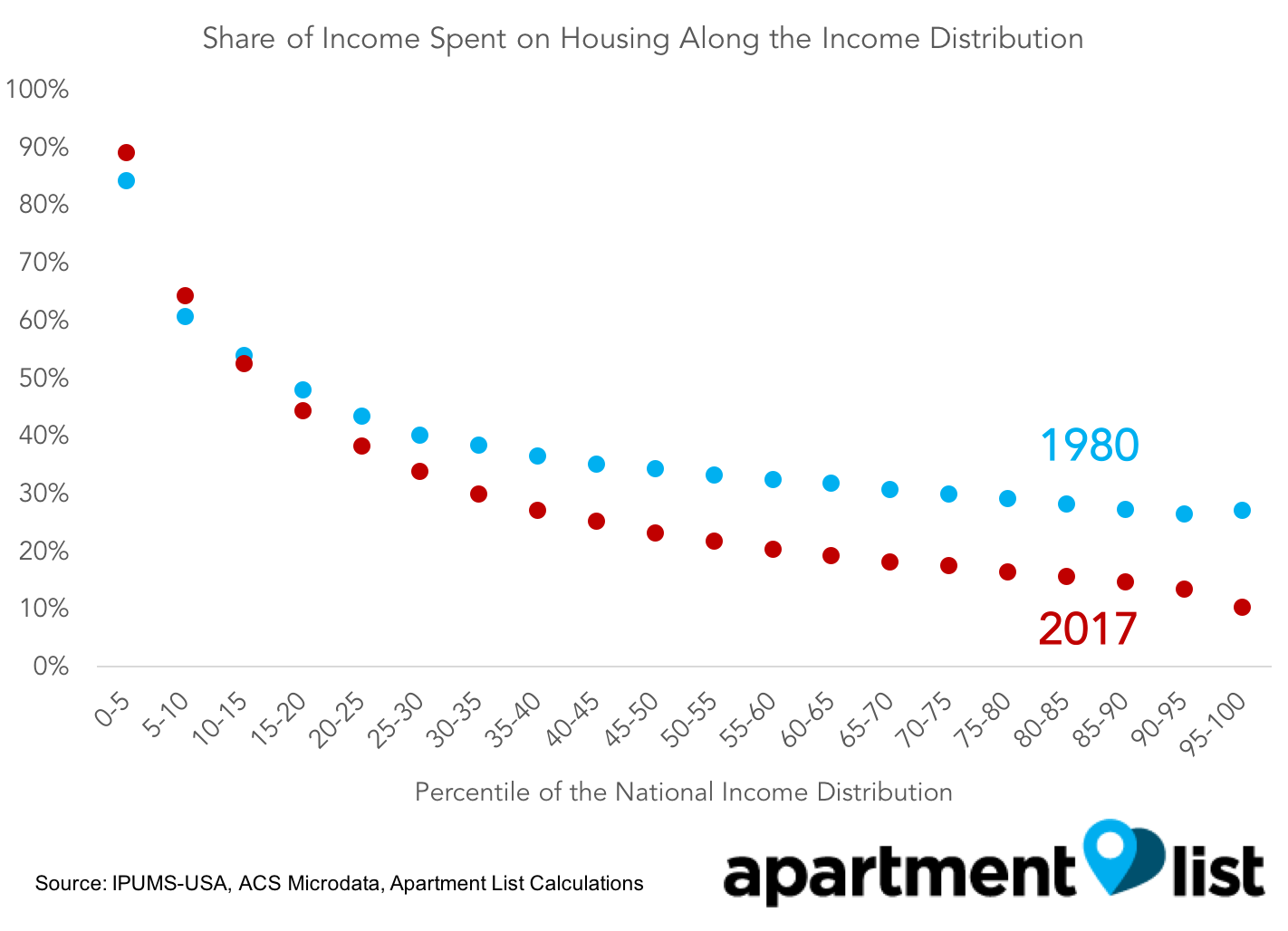

The graph below shows the percent of income the poorest and richest Americans spend on their housing costs. You can see that the bottom 10 percent of incomes spent a higher percentage of their income on housing costs in 2017 than they did in 1980, while the top earners spent less.

“Housing policy is inequality policy,” Igor Popov, Apartment List's chief economist, told CityLab. “When you accelerate what happens with the potential savings that the folks at the top are getting versus the folks at the bottom, they can use that to invest, and they can use that to take more risks. And that just fuels the problem.”

Some have called America's income inequality a "national emergency" and academic researchers and politicians have taken note of the growing issues of income disparity.

Houston has been named one of the most inequitable cities in America with households with incomes in the top 4 percent earning nearly 10 times more than households in the bottom 20th percentile.

According to the Apartment List report, residents in Houston's bottom 25 percent of income distribution make 27 percent as much as the median household, but they still need to pay 85 percent of what the median household does each month for housing. Nationally, those percentages are 27 and 79 percent, respectively. "America's poor earn just a fraction of the median family's income, but their housing costs are not too different," the report said.

Further, when looking at the 90-10 ratio, a common measure of inequality for metros over time, Houston ranks 12th in the nation and first in Texas for rising inequality between the rich and the poor with a 16.3 percent growth between 2008 and 2017. The greatest disparity between rich and poor residents is found in Philadelphia, while New Orleans has witnessed the greatest inequality growth over the past ten years, the report notes.

"There is no silver bullet solution," the report concluded. "As policymakers and researchers continue to design and test policy proposals, however, it is important to keep in mind that housing and labor markets are inextricably linked. Housing policy has the potential to alter the course of evolving inequality, and vice versa."