Another measure of housing crisis fallout? More families with children are renting, according to an analysis by RentCafe of the 30 largest metropolitan areas over a 10-year period that includes the recession. Between 2006 and 2016, the number of families with children who owned their homes dropped by 3.6 million across the country, according to the analysis, while the number of families with children renting increased by 1.9 million.

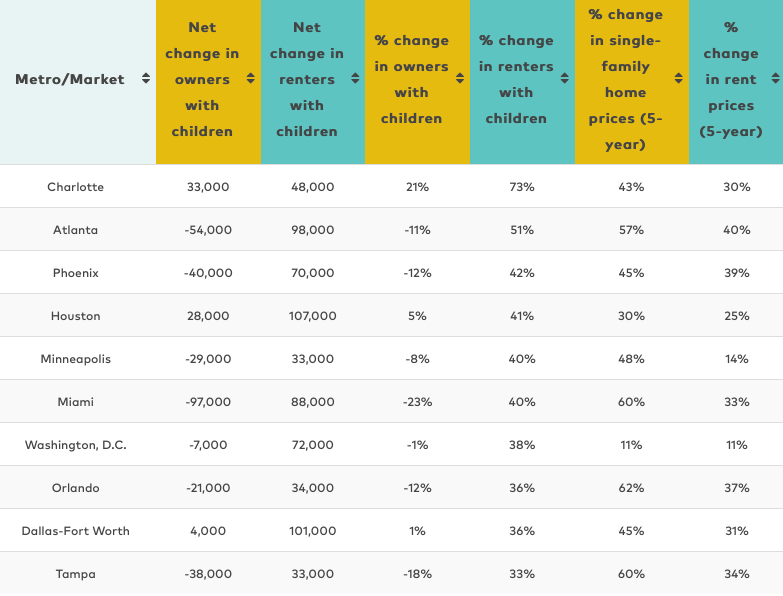

Some of the biggest increases in renter households with children between 2006 and 2016 occurred in fast-growing Sun Belt cities like Charlotte, Atlanta, Phoenix, Houston and Miami. In fact, Houston had the largest numerical increase, with a net gain of 107,000 renter households with children. But while Atlanta, Miami and Phoenix, among others, also had a negative net change in homeowner households with children. Houston also saw overall gains here too, with a net increase of 28,000.

While 10 years is a small interval, the analysis argues that this shift reflects the "tremendous effects of this relatively short but eventful period of time on American families." The loss of homeowner households with kids, the analysis argues, represents homes lost in foreclosure during the housing crisis as well as "families who are unable to overcome the current financial barriers to become homeowners." The measure also includes families whose kids are no longer minors and thus no longer count as households with kids and it captures inputs beyond the housing crisis, like burdensome childcare costs and changes in the national birthrate. The analysis also captures the rising rents and housing costs in many of these cities.

Others have reflected on the failure of wages to keep up with housing cost increases, but housing is just one of the growing concerns for families and consumers. "We see a relatively slow growth in wages compared to faster-rising expenses," Elise Gould, a senior economist at the Economic Policy Institute, told NBC News, adding, "we see that in homes, healthcare, childcare, many of the necessary expenses families pay."

The increase in families that rent also reflect broader shifts as the number of renter households, in general, reached its highest level in 2016 since at least 1965, according to another analysis by Pew Research Center. While homeowner households remained relatively flat between 2006 and 2016 dropping slightly from 76.1 million to 75 million, the number of renter households climbed from 34.6 million in 2006 to 43.3 million in 2016.

Source: RentCafe.

The recession resulted in roughly eight million foreclosures and a loss of some $7 trillion in home equity, according to a recent article in the Journal of Economic Perspectives. These outcomes were not evenly distributed. For example, while that same study found that homeownership rates tended to drop from 2005 to 2015 across the board, some populations had much larger decreases, in addition to starting from very different points. For example, married couples with kids had a homeownership rate of 79.1 percent in 2005 and 70.8 percent in 2015. But for single mother households, that rate went from 42.5 percent to 32.8 percent. In fact, single mother households had the lowest rates of homeownership overall. Looking historically, the study found that, "Homeownership declined for all types of households with children between 1985 and 2015, whether or not headed by a married couple." There are also well-documented gaps between different racial and ethnic groups. For the white-black homeownership gap, in particular, the study notes that previous research has documented the importance of parental wealth, which explains up to 65 percent of the gap.

So what does homeownership rate really mean about the health of a metropolitan area or community?

The 2005 rates cited in the study could be partly a product of "nontraditional products and relaxation of credit standards." In other words, specific policies and practices helped create an increase in homeownership, not so much income growth or other factors, the report explains. The decrease, then, from 2005 to 2015 has to do with the fallout from those practices and the recession, as well as rising "student loan debt, tight credit, and a shift in attitudes toward homeownership" and it's worth trying to disentangle those causes.

Some of the shift in family homeowner to renter households might, for example, represent skepticism about the value of homeownership or other preferences in addition to the financial barriers, the RentCafe report mentions, not the least of which is the downpayment that can weigh more significantly in a decision than a comparison of monthly housing costs.

Indeed, homeownership is far from a uniform experience. For some, particularly for households with incomes toward the "bottom part of the income distribution" it means "potentially large financial risks associated with owning a single, undiversified, indivisible, sometimes illiquid asset that often represents the vast majority of their wealth," the study notes. There is a range of studies that suggest that homeownership, while a vehicle for wealth creation for some, is far from a reliable tool for all. Though the article ultimately argues that homeownership "remains beneficial for most families" it also cites research done before the recession that showed that buying a home did not guarantee an increase in wealth and that "home prices at the lower end of the market" were particularly volatile.

Still, the authors, ultimately argue that the pendulum may have swung too far away from encouraging homeownership after the recession despite these complicating conclusions.

Cities should also consider the relative cost burdens faced by different populations. In the Houston metropolitan area, renters are much more likely to be considered cost-burdened than homeowners, meaning they spend more than 30 percent of their income on housing costs. Roughly 45 percent of renters are cost-burdened, according to Census data, compared to 22 percent of homeowners.

For many renters, financial constraints keep them from buying a home. In surveys, most express interest in one day buying a home. A 2016 Pew Research Center survey found that 72 percent of renters wanted to buy a home eventually and just 32 percent of renters said they rented out of choice rather than circumstance. Financial reasons were the main impediment cited by respondents, including the down payment, the cost of the home itself and wanting to pay down debts.