The lack of savings American families have in case of an income dip, like losing a job or unpaid sabbatical, or an expenditure spike, like medical bills, emergency automobile repair or large, one-time expenses, contribute to this gap.

Many personal finance advisors recommend families keep three to six months worth of expenses in their savings, but this conventional wisdom needs to be improved on, a recent JP Morgan Chase Institute report challenges. The report argues that this goal is unrealistic for many families and does not take into consideration specific demographic groups who experience unique financial situations.

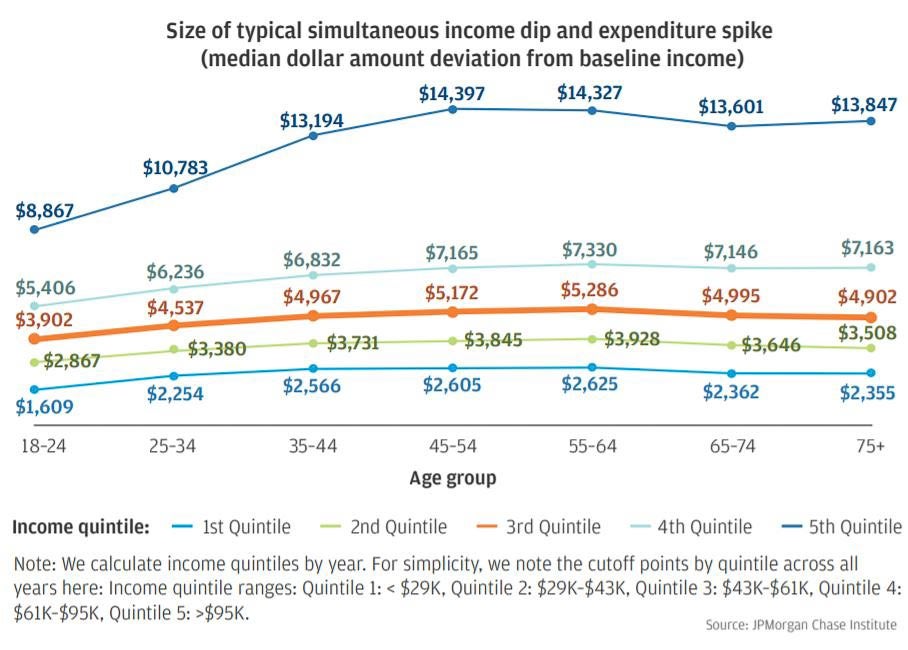

The report suggests a person's required income buffer needs to be determined on a case by case basis by the family size, age of the head of house and income range. For example, the report suggests middle-age, middle income families need at least $5,000 to weather a simultaneous income dip and expenditure spike, according to the report.

Source: JPMorgan Chase Institute

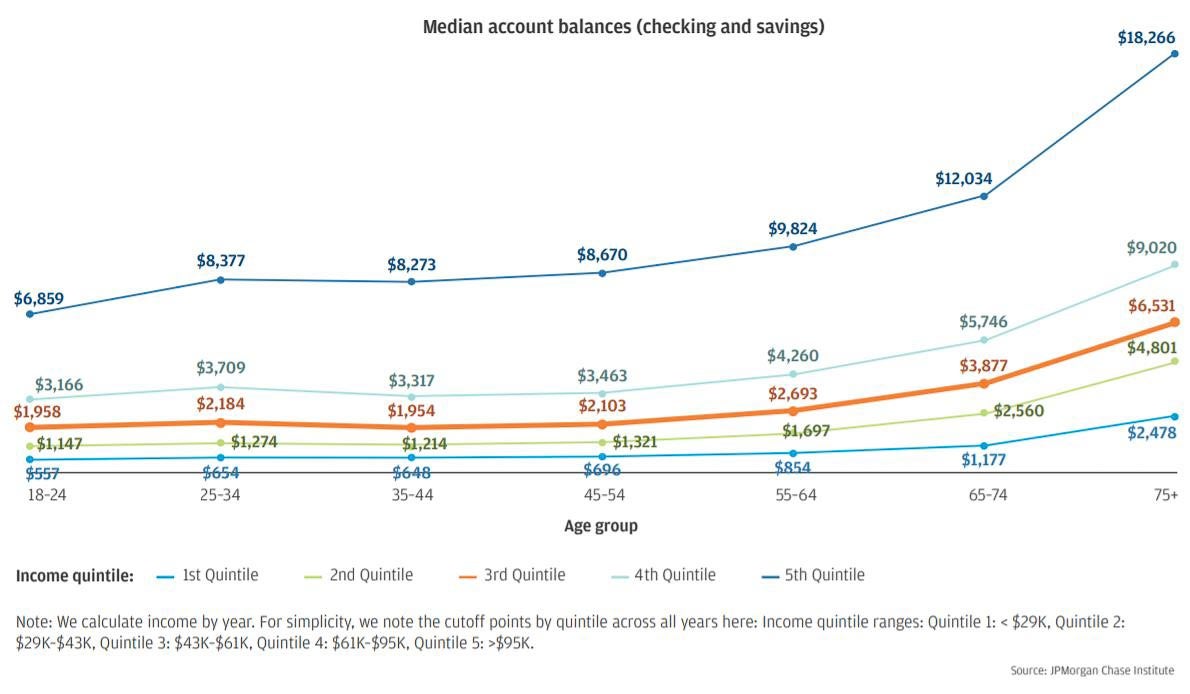

In comparison, the median account balances for both checking and savings for most families, as seen in the chart below, don't come close to the suggestions laid out in the graph above.

Source: JPMorgan Chase Institute

"For a simultaneous income dip and expenditure spike, families generally need roughly six weeks of income in liquid cash buffer, which is lower than the existing advice of three to six months," the report said. "Families need roughly three weeks of income to weather an income dip or an expenditure spike and they happen on average every four months and nine months, respectively."

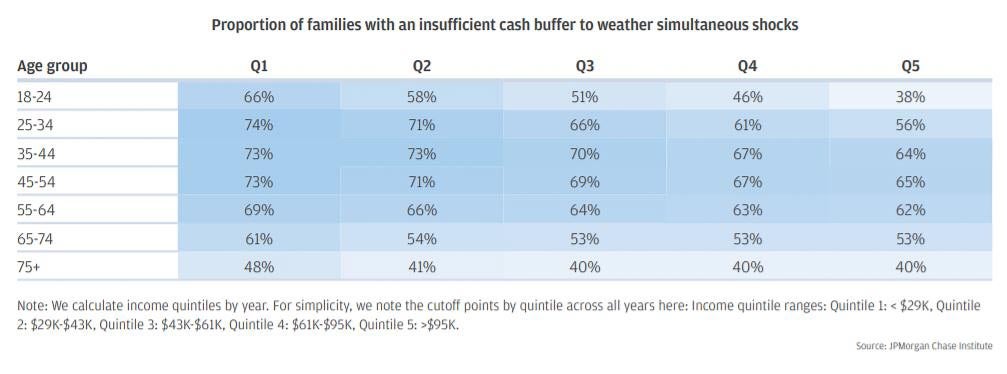

But if both an income dip and an expenditure spike occur at the same time, the report says 65% of American families don't have six weeks of take-home income in liquid assets as a buffer during times of crisis. Additionally, the likelihood of a family having that cash buffer goes down across all income levels during the ages of 25 to 54.

Source: JPMorgan Chase Institute

Additional research has shown 39% of families report that when faced with an unexpected expense of $400, they would need to either borrow or sell property to cover it at all. The same percentage was found within Houston, according to the 2019 Kinder Houston Area Survey.

"The widespread prevalence of poverty and homelessness in this affluent metro region is increasingly difficult to ignore," said Stephen Klineberg, founding director of the Kinder Institute for Urban Research, in his report.

"These findings should remind Houston’s civic leaders, so many of whom are working hard to develop effective responses to the region’s economic and demographic challenges, that area residents are increasingly open to supporting new initiatives along these lines," Klineberg said in his report. "It remains to be seen whether the community as a whole can summon the political will to undertake the critical long-term investments that will be needed in order to position the Houston region for sustained prosperity as the twenty-first century unfolds."