This post is part of a series by the Kinder Institute for Urban Research addressing the findings of the 2021 State of Housing in Harris County and Houston report.

“We are witnessing the most energized Houston real estate market in history,” Houston Association of Realtors Chairman Richard Miranda said in a June 6 monthly update. “It’s difficult to predict how and when this incredible housing run will end.”

At the same time, the economic fallout from the pandemic continues to raise the specter of evictions and homelessness, which remain a source of concern as extra unemployment assistance is set to expire in Texas this week on June 26. Meanwhile, the federal eviction moratorium ends June 30.

We do not know what the next few months will hold. But what we do know is that coming into the pandemic and the other challenges that 2020 posed, the Houston and Harris County housing sector was becoming increasingly unaffordable for the growing renter population and that the supply of housing units was far below demand, setting up a precarious situation for hundreds of thousands of households.

The Kinder Institute’s second annual State of Housing report, published today, dives into the area’s housing profile, providing both neighborhood data and big-picture implications for policymakers, housing providers and residents. This year’s report tracks the status of the housing system at the county and city levels. The report also includes public access to neighborhood-level indicators through the 2021 State of Housing Dashboard, which allows residents to better understand the housing situation around them.

As with last year’s report, this year's study found the housing sector in Houston and Harris County is failing many and rewarding too few, a problem common among major metro areas in the U.S. For higher-income residents and most homeowners, the system is creating large benefits and stability. Yet lower-income households, especially lower-income renters, find themselves squeezed into homes that are unaffordable and oftentimes unsafe. For these residents, access to the ranks of homeownership and the inherent benefits that come with it are growing more elusive.

These divergent paths have also been magnified by the ongoing effects of the COVID-19 pandemic and Winter Storm Uri, whose impact will ripple over the region’s housing system for years to come. The “State of Housing” report relies on data collected before those disruptions, but Kinder staff hopes to use these and other indicators to better understand the pathways these disasters could lead us down. For example, foreclosures and evictions have remained high during the pandemic, but they were slowed by targeted policies. However, the long-term future of these policies is uncertain.

The search for affordable living situations has led to an increase in overcrowding even as Houston overall is seeing households shrink. Severely overcrowded homes (those with more than 1.5 residents per room) increased by around 25% in the city and county between 2018 and 2019. Amid the pandemic, this meant that if one person catches the disease at work, it is harder to isolate from other people in the home, who in turn get sick, miss work and lose income, thus making them even more vulnerable. Researchers consistently found a relationship between housing precarity and COVID-19 transmission: More overcrowding, eviction and foreclosures meant more COVID-19 cases and more deaths.

Housing is an essential building block for wealth creation. For those with access to the system, ownership provides an entrée into generational wealth. People who can afford higher rents in high-amenity communities that are close to opportunities have more pathways to success. However, for those unable to afford safe homes or build equity through ownership, there are few avenues to building wealth or creating stability.

It is our hope that our report can help steer the search for both public and private solutions to these challenges.

Key findings include:

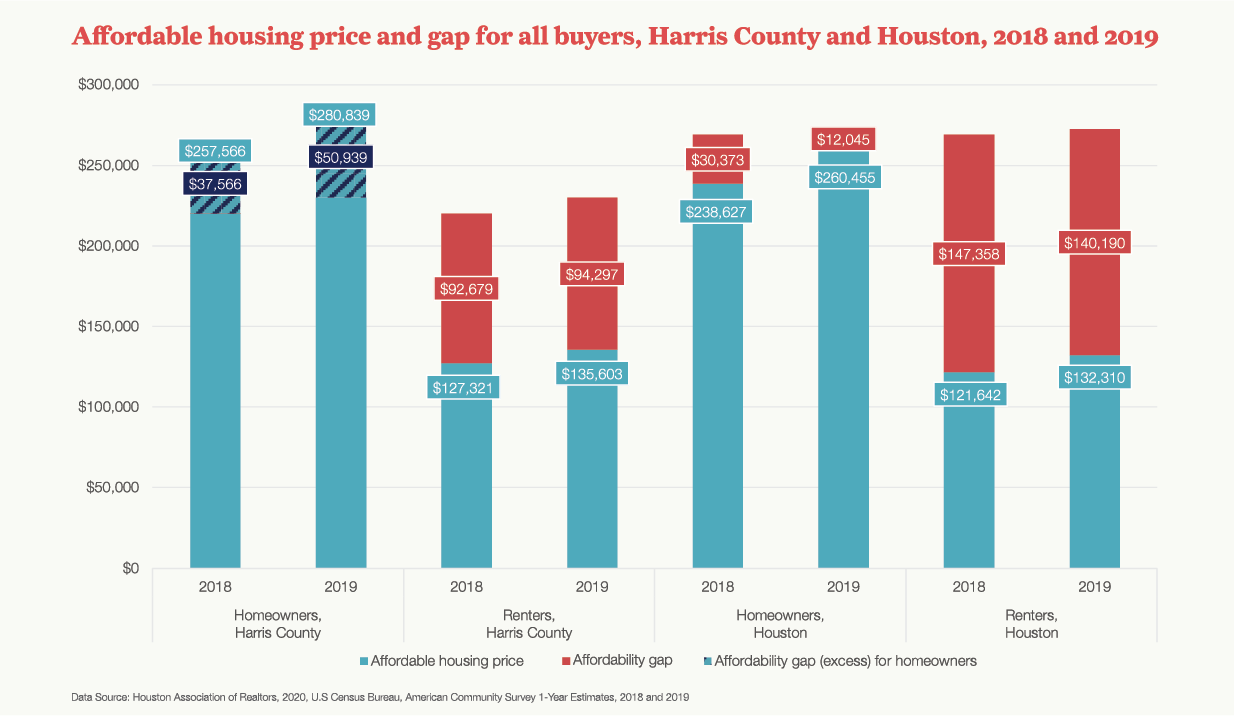

- Overall, the affordability gap is shrinking, but not for renters.

- Beyond not being able to own a home, a growing share of renters have difficulty paying the rent on the homes in which they already live.

- Perhaps because of local renters’ housing insecurity, Harris County has a high eviction rate.

- More knowledge about landlords will help stakeholders better understand the dynamics of a renter-majority city (and soon-to-be majority-renter county).

- Affordable housing supply does not keep up with demand, and rising construction costs suggest this problem will grow.

- Not only the poor, but also middle-income renters and buyers are increasingly squeezed.

- Houston is adding households but losing people, showing that households are getting smaller; meanwhile, larger households are locating in suburban Harris County.

- Houston and Harris County are becoming older and less diverse, while the rest of the metro area outpaces their growth.

- Economic segregation and inequality remain a pervasive issue that transcends housing and affects Houstonians’ prospects of upward mobility.

- Flooding is a growing risk: Homes are still being built in the existing 100- and 500-year floodplains.

- Cost-burdened households have fewer resources to help them weather the next disaster.

- The suburbs are the site of a growing trend in concentrated poverty.

In future blog posts, our researchers will tackle some of the emerging challenges, from rising flood risks to trying to understand the role played by real estate investment trusts in the local housing market.