The numbers for Mayor Sylvester Turner’s pension reform plan generally add up, and the reforms generally move Houston in the right direction. In fact, this pension reform plan should be viewed by other cities as a national model, especially its risk-sharing aspect.

That’s the conclusion of a new analysis of the reform plan by the Kinder Institute for Urban Research and the Center for Retirement Research at Boston College. You can quibble with some things, and the whole plan is not without some risk. But generally speaking it is a strong move in the right direction.

All three Houston pension boards have now signed off on Mayor Sylvester Turner’s pension reform plan, and the City Council is scheduled to vote on it Wednesday. Assuming the council okays the deal, it will go to Austin for legislative action next year.

The deal is not significantly different than what Turner announced in September. But now we have more details about the overall numbers and the specifics about the pension reforms, the pension obligation bond, and the risk-sharing agreement or “corridor.”

In August, the Kinder Institute issued a report laying out options for reform. In September, after Turner’s initial press conference, the Kinder Institute issued a quick analysis. What follows is the result of our quick analysis of the new details issued over the last week.

The Deal and The Numbers

If you read our September blog post, you’ll remember that the deal went like this:

- Assumed rates of return would drop from 8% or 8.5% to a more realistic 7% for all three pension systems.

- Instead of using an open amortization period that resets every year, the city would use a closed 30-year amortization period.

- These two changes, along with some other miscellaneous recalculations, meant the city’s unfunded liability is $7.8 billion.

- The three pension boards would agree to then-unspecified reforms totaling around $2.6 billion, bringing the unfunded liability down to $5.2 billion.

- The city would issue a $1 billion pension obligation bond, which would bring the total unfunded liability down to $4.2 billion, though the city would still have to pay off the bond.

- The total annual cost -- including the cost of paying off the bond -- would be within the city’s current budgeted amount for pension payments.

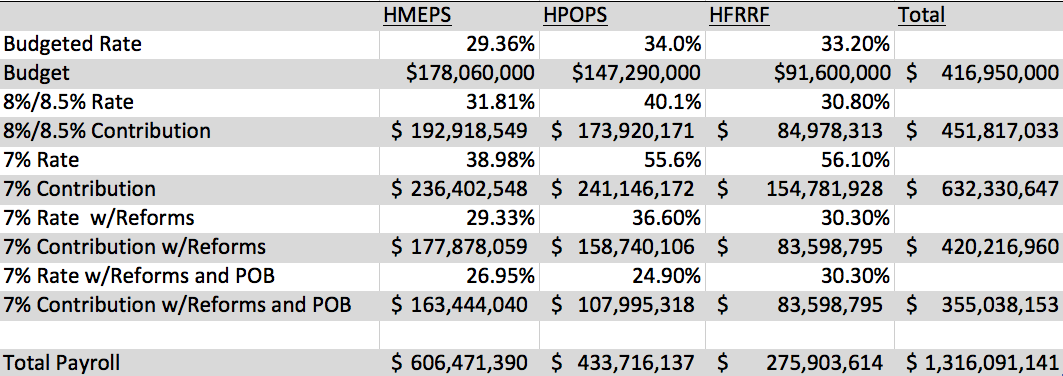

It was a little hard to tell from the September information just whether and how the numbers added up. But as the table below shows, they actually do add up, assuming the 7% return on investment works out. Most specifically:

- The city’s FY 17 budget assumes that the pension payment will be 33.2% of payroll, or about $416 million.

- After accounting for changed assumptions and proposed reforms but before accounting for the pension bond, the FY 17 pension payment would be 30.3% of payroll, or about $420 million.

- Accounting for the $1 billion pension bond – which will be applied to unfunded liability for both municipal employees and police – the FY 17 pension payment would be about $355 million, leaving $65 million to pay off the bond. This is sufficient to pay off a $1 billion bond at a 5% interest rate.

Reforms

The $2.6 billion in reforms comes entirely from increased employee contributions and changes to the COLA (Cost Of Living Adjustment) and DROP (Deferred Retirement Option Program).

Increased Employee Contributions

Police (10.25% of salary) and fire (10.5%) will now pay higher than the national average for public safety employees (9%). When measured against the “normal” cost – that is, the cost of benefits earned for each year of work – the police and fire contributions are right around the national average because Houston police officers and firefighters receive higher-than-average benefits.

Municipal employees will also pay higher contributions, including 8% for Group A (hired before 2008), 4% for Group B (hired before 2008), and 2% for Group D (hired after 2008). Group D employees currently pay no contributions but also receive much lower benefits.

The national average is currently 7.6% of salary for non-public safety employees and amounts to about half of the average normal cost. By comparison, Group D employees pay about half of the normal cost, Group B employees pay a bit more than half, and Group A employees pay almost all.

COLA Reforms

All three pension boards agreed to COLA reforms, but all the deals are different.

Most police retiree COLAs will be frozen for three years and then linked to social security COLAs but capped at 2.5%. This is a best practice, protecting retirees’ purchasing power while also protecting the city in the event of high inflation.

Firefighters will also take a three-year freeze and then receive COLAs linked to social security increases, but there is no cap. This could be a significant financial risk for the city if inflation ever increases dramatically.

Municipal employees will continue to receive a 1% COLA. If inflation in the future continues at around 2%, as it has for the past 20 years, retirees’ buying power will erode over time.

DROP Reforms

DROP is an option available to many city employees, especially those who have worked for the city for a long time. Employees leave the pension system while still working, meaning they begin receiving their pensions in addition to their salaries, and those pensions are then deposited into a DROP account on their behalf. When they leave the DROP system, the employees receive a lump sum and then begin collecting their pension directly. Only about 30% of large local government pension plans nationally have DROP programs.

The DROP program is intended to incentivize a small number of valued employees to keep working even after their pension benefits have been maximized, but in Houston it has been used by the vast majority of employees, partly because they are permitted to stay in the program for a long time.

The typical allowable period to remain in a DROP program is five years, but police officers and firefighters in particular stay longer. Police officers will be permitted to stay in DROP for between 10 and 20 years, while firefighters will be able to stay in DROP for between 7 and 10 years. New municipal employees are not eligible for DROP.

For all three programs, DROP participants are guaranteed a minimum rate of return ranging from between 2.5% and 4% per year.

Shared Risk (The Corridor)

One of the most important features of the Houston reform plan is the shared risk or “corridor” concept. Under this concept, if investment returns are higher or lower than expected, negotiations will automatically be reopened between the city and the pension boards. Specifically, negotiations will be opened if the investment returns require an annual city payment of 5% or more above or below the expected payment. The negotiations must yield changes that will bring the payment back to +/- 5% within three years.

The proposed agreements contain excellent framing language, explaining that the normal market fluctuations should be managed by the city, but the city and employees must share the burden of unusual economic events either good or bad. Other cities and states should consider using this framing language.

The main goal, of course, is to ensure that if the investment returns are low, the combined contributions from the city and the employees do not underfund the pension system, as has happened in the past. More benefit cuts or employee contributions may be required. But as an inducement to accept this idea, the shared risk concept also requires a renegotiation if investment returns are higher than expected, opening the possibility of restoring benefits or paying unfunded liability down faster than expected.

The city’s plan does not specify what benefit cuts or increased employee contributions might go into effect as a result of the poor returns, only that negotiations are reopened. This is probably fine so long as the investment returns do not drop the pension funds below the corridor on a regular basis. If the investment consistently falls below 7%, it’s likely that the city and the pension boards will be in constant negotiation.

Pension Obligation Bond

A pension obligation bond has many benefits. Among other things it provides the city with flexibility in cash-flow and in scheduling future payments. As Boston College’s Jean-Pierre Aubry noted at our recent panel discussion on pensions, bonding the pension debt puts the debt in the hands of people who are making a business decision to acquire it (bond buyers) rather than the hands of plan participants who would rather not have unfunded pension liabilities.

The risk, of course, is that the city is floating a bond without generating any additional revenue to pay the bond. As stated above, the city should save enough money from pension reforms to cover the payment on a $1 billion floated at 5% -- assuming the pension boards consistently hit the 7% return on their own investment funds.

Defined Contribution Plans

Both Mayor Turner and the pension boards have consistently rejected the idea of switching to defined contribution plans (i.e., 401K-type plans), rather than guaranteed pensions, for new employees and such a system is not part of the mayor’s plan. Turner has been consistently criticized by his 2015 runoff opponent, Bill King, for not supporting the defined contribution concept.

The upside of a defined contribution system is that it assures that the unfunded liability problem won’t get worse many years down the road, because the city is not responsible for covering the cost of a guaranteed pension if investment returns are low. But a defined contribution system would not help reduce the current unfunded liability and some critics say it can harm recruiting.

HMEPS = Houston Municipal Employees Pension System

HPOPS = Houston Police Officers Pension System

HFRRF = Houston Firefighters Retirement and Relief Fund (correct?)

“Budgeted Rate” = percentage of payroll required to make city’s FY 17 budget payment to pension funds.

“Budget” = amount required to make required to make city’s FY 17 budget payment to pension funds. Derived by multiplying budgeted rate by total payroll.

“8%/8.5% Rate” = percentage of payroll required to make city’s full required FY 17 budget payment to pension funds, using each pension board’s current assumption for annual investment returns (8% for HMEPS and HPOPS, 8.5% for HFRRF).

“8%/8.5% Contribution” = amount required to make city’s full required FY 17 budget payment to pension funds, using each pension board’s current assumption for annual investment returns (8% for HMEPS and HPOPS, 8.5% for HFRRF). Derived by multiplying 8%/8.5% rate by total payroll.

“7% Rate” = percentage of payroll required to make city’s full required FY 17 budget payment to pension funds, using reform plans'” assumption for annual investment returns (7% for all three systems).

“7% Contribution” = amount required to make city’s full required FY 17 budget payment to pension funds, using reform plans” assumption for annual investment returns (7% for all three systems). Derived by multiplying 7% rate by total payroll.

“7% Rate w/Reforms” = percentage of payroll required to make city’s full required FY 17 budget payment to pension funds, using reform plans’ assumption for annual investment returns (7% for all three systems) and subtracting the $2.5 billion in reforms contained in the reform plan.

“7% Contribution w/Reforms” = amount required to make city’s full required FY 17 budget payment to pension funds, using reform plans” assumption for annual investment returns (7% for all three systems) and subtracting the $2.5 billion in reforms contained in the reform plan. Derived by multiplying 7% rate w/reforms by total payroll.

“7% Rate w/Reforms and POB” = percentage of payroll required to make city’s full required FY 17 budget payment to pension funds, using reform plans” assumption for annual investment returns (7% for all three systems) and subtracting the $2.5 billion in reforms contained in the reform plan and a $1 billion Pension Obligation Bond.

“7% Contribution w/Reforms and POB” = amount required to make city’s full required FY 17 budget payment to pension funds, using reform plans” assumption for annual investment returns (7% for all three systems) and subtracting the $2.5 billion in reforms contained in the reform plan and a $1 billion Pension Obligation Bond.

“Total Payroll” = Total amount of city payroll expenses in FY 17 budget.